Fixed Income in Focus:

The market opened the week with net positive liquidity balances as investors positioned ahead of the mid week NTB auction. The auctioned 364-day paper cleared 25bps higher than the previous issue at eff. 21.48%, pressured by an oversupply of ₦162bn on the long end. The bond market traded on a bullish tilt, supported by dovish policy expectations. Yields compressed across the curve, notably the FGN 31s & 32s, as investors sought safety in longer maturities. OMO trading was active, with flows centered in November maturities around 25.50%. Liquidity remained positive despite the activity, closing the week at ₦1.6tn.

Nigerian Equities:

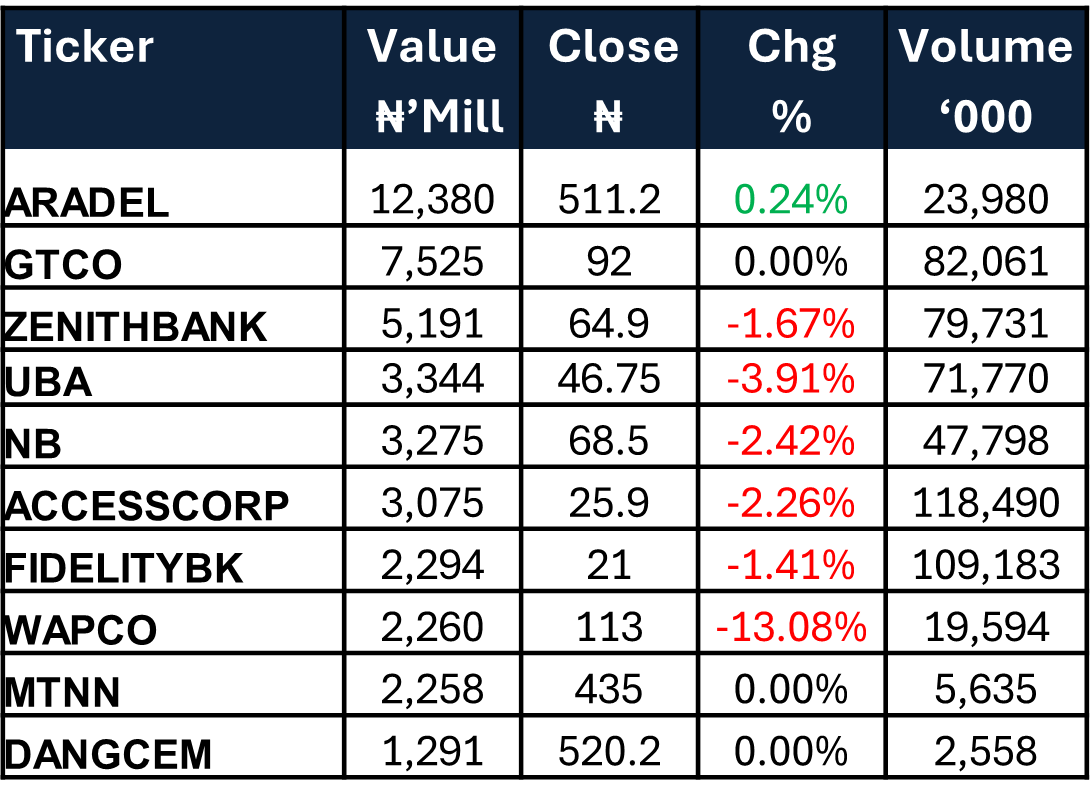

The ASI slipped 0.94% to 138,980.01,its third weekly decline, led by Industrials and Banking with a decline of 2.08% and 1.52% respectively,while Insurance at 0.36% showed relative resilience. WAPCO dropped to ₦113 following Holcim’s divestment. Financials drove nearly 70% of volumes, underscoring sector-led volatility. We expect sentiment to remain cautious in the near term as investors await clarity from H1 banking results.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 34.703 | 38.355 | 512.190 |

| Stop Rates | 15.32% | 15.50% | 17.69% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.75 | 17.40 | 36 |

| Feb-31 | 17.70 | 17.25 | 45 |

| Jun-32 | 17.70 | 17.30 | 40 |

| May-33 | 17.55 | 17.08 | 47 |

| Jun-53 | 16.00 | 16.00 | – |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 03-Sep-26 | 17.40 | 17.25 | 20.83 |

| 20-Aug-26 | 16.70 | 16.70 | 19.88 |

| 5-Mar-26 | 17.70 | 17.50 | 19.17 |

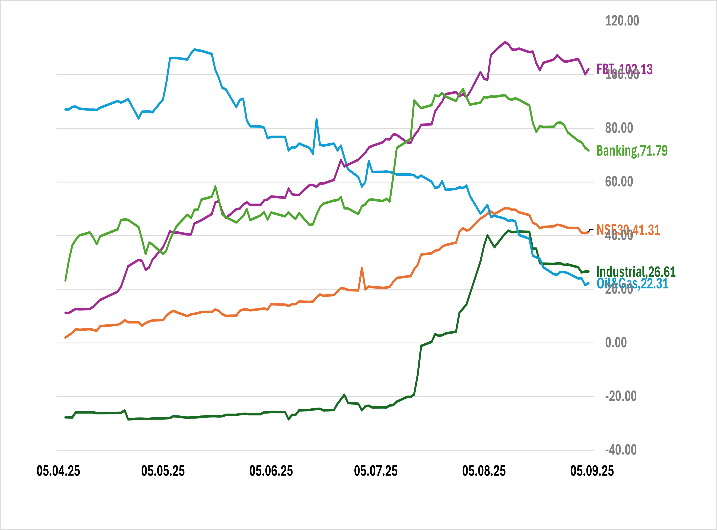

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens quietly, with no major macroeconomic releases and no scheduled auctions. Market focus is instead on an expected ₦184bn NTB maturity inflow, which should further reinforce already positive liquidity balances.

With system liquidity set to rise, participants anticipate stronger buying interest across the curve. This is expected to drive demand in mid to long tenor bills and a broad tightening of secondary market yields. In the absence of fresh supply, ample liquidity is likely to sustain a bullish tone across both NTB and bond segments.