Fixed Income in Focus:

System liquidity opened strong at ₦1.29 trillion, supported by NTB and OMO maturities. FGN bonds and OMO bills saw firm activity, with the 2031s and 2033s actively traded and the 10 March OMO bill at 22.45 %. Back-to-back OMO and NTB auctions led to some profit-taking, though the NTB auction cleared at previous levels and saw solid follow-up demand. Liquidity closed the week at ₦684 billion reflecting a ₦563 billion contraction, largely driven by auction sales.

Nigerian Equities:

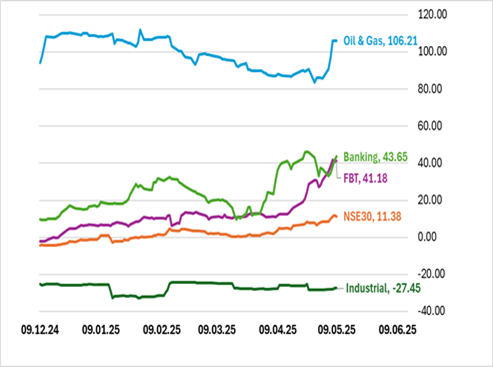

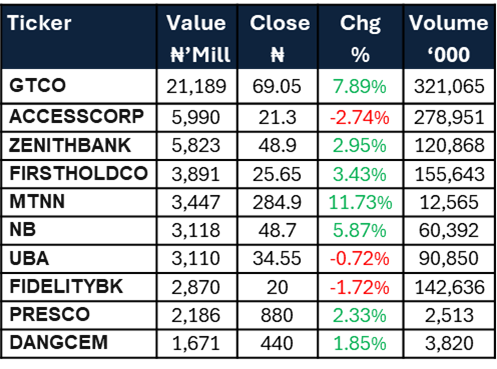

The All-Share Index appreciated an impressive 2.54% this week. Heavy demand for Food & Beverage, Oil & Gas, and Banking stocks prevailed as implied by the 5.41%, 3.98%, and 3.09% gains in their respective indices. The bullish sentiments may reflect higher earnings expectations in wake of positive outcomes from US trade negotiations. Investor interest may continue to build as key macroeconomic data is released domestically.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 77.21 | 38.49 | 482.61 |

| Stop Rates | 18.00% | 18.50% | 19.63% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.40 | 19.45 | (5) |

| Feb-31 | 19.75 | 19.95 | (20) |

| May-33 | 19.90 | 19.95 | (5) |

| Jan-35 | 19.55 | 19.50 | 5 |

| Jun-53 | 17.00 | 17.00 | 0 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 07-May-26 | 19.55 | 19.40 | 24.01 |

| 23-Apr-26 | 19.30 | 19.20 | 23.49 |

| 09-Apr-26 | 19.20 | 19.15 | 23.20 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

With no auctions scheduled, the spotlight this week is on April inflation data due Thursday. The release will be closely watched for signs of continued price pressure, which would shape near-term trading sentiment.

A ₦143 billion coupon inflow from the May 2033 bond is expected to boost system liquidity, helping to support demand. Investors may remain cautious ahead of the data, with interest likely focused on short and mid-tenor bonds where yields remain attractive.