Fixed Income in Focus:

The week in view saw a wave of short to long-dated securities, met with solid demand. Yields continued to edge lower as aggressive bidding continued, pointing to a lasting shift in investor preference toward the long end of the curve. The trend has persisted through the month, backed by strong liquidity and steady supply. OMO bills led activity, with yields topping out slightly above 27%. Interest also held firm in the bond space, especially around the 2035s and 2033s. Liquidity remained robust, closing the week at ₦1.89trillion.

Nigerian Equities:

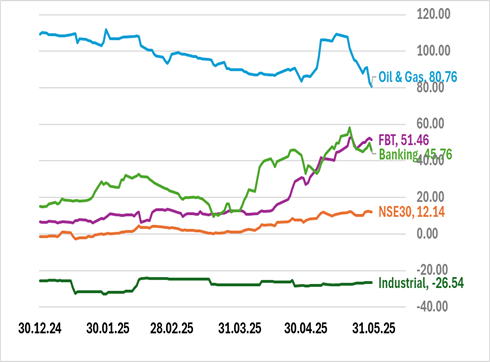

The All-Share Index rebounded to record a 2.49% gain this week. This momentum was driven by strong investor interest in premium tickers and consumer goods evidenced by the 2.25% and 3.78% gains of NSE30 and Consumer Goods respective indices. Noticeable cross sells in MTNN and UBA took place to provide the necessary liquidity for a potential bullish swing this upcoming week. Oil and gas stocks still erasing last year’s gains despite positive developments locally.

Bond Auction Result

| 19.30% 2029 | 19.89% 2033 | |

| Sales (₦‘bn) | 4.705 | 295.988 |

| Marginal Rates | 18.98% | 19.849% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.50 | 19.00 | 50 |

| Feb-31 | 19.85 | 19.45 | 40 |

| May-33 | 19.85 | 19.60 | 25 |

| Jan-35 | 19.30 | 19.00 | 30 |

| Jun-53 | 17.00 | 17.00 | 0 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 21-May-26 | 19.05 | 19.00 | 23.29 |

| 07-May-26 | 19.30 | 19.05 | 23.16 |

| 05-Mar-26 | 19.60 | 19.35 | 22.68 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The CBN is set to conduct back-to-back auctions this week, with ₦600 billion in OMO bills and ₦450 billion in NTBs on offer. These come against an expected ₦321 billion in NTB maturities, providing some liquidity support. However, a potential CRR debit could tighten conditions slightly ahead of the auctions.

Investor attention is likely to skew toward the OMO auction, driven by its larger issue size and significantly higher yields in the secondary market. The results will likely set the tone for the rest of the trading week, with the NTB auction drawing less focus unless pricing surprises.