Fixed Income in Focus:

The banking system opened the week with a positive liquidity balance of ₦1.6 trillion, holding steady throughout. Monday’s bond auction reopened the Apr 2029s and May 2033s. Though some expected higher stop rates in line with OMO yields, the auction cleared flat, falling short of expectations. Post-auction, the May 2033s led activity, trading around 19.90%.Demand weakened for NTBs after Tuesday’s OMO announcement, as investors adjusted their positions ahead of potential liquidity tightening and rising yields. Despite the back-to-back auctions, liquidity stayed positive, closing at ₦1.2 trillion

Nigerian Equities:

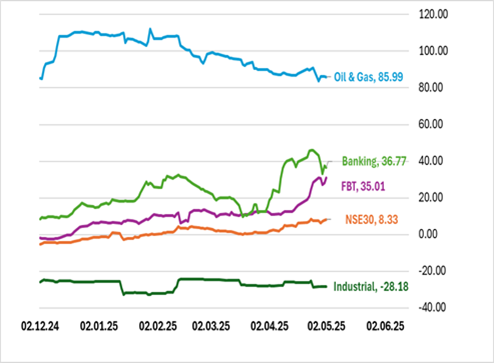

The All-Share Index inched upward 0.27% as firms meet the Q1’25 result deadline. Tier 1 banks released mixed results as impressive revenue growth struggled to translate to significant profit growth. Profit taking prevailed as Oil & Gas and Banking index declined by 2.90% and 0.38% respectively. We expect investor demand to persist as value plays are identified from Q1’25 earnings.

FGN Bond Auction Result

| FGN Apr 2029 | FGN May 2033 | |

| Sales (₦‘bn) | 21.12 | 376.77 |

| Stop Rates | 19.00% | 19.99% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.00 | 19.00 | 0 |

| Feb-31 | 19.80 | 19.95 | (15) |

| May-33 | 19.80 | 19.95 | (15) |

| Jan-35 | 19.45 | 19.45 | 0 |

| Jun-53 | 16.95 | 16.90 | 5 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 23-Apr-26 | 19.30 | 19.20 | 23.61 |

| 9-Apr-26 | 19.20 | 19.15 | 23.32 |

| 26-Mar-26 | 19.30 | 19.25 | 23.26 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

All eyes are on Wednesday’s ₦550 billion NTB auction, supported by ₦527 billion in expected inflows from NTB and OMO maturing. Early-week activity may include some offloading as investors reposition ahead of the sale.

Given the system’s positive liquidity position, there’s a strong likelihood of oversubscription, which may prompt the CBN to increase the offer size to absorb excess funds. Yield direction will depend on demand strength and where stop rates eventually settle relative to secondary market levels.