Fixed Income in Focus:

Week under review saw significant demand on long dated OMO and NTB maturities buoyed by strong system liquidity and issuance of only mid tenured OMO bills. In addition to this, NTB auction during the week saw a decline in marginal rates by 7bps from the previous auction despite the MPC maintaining status quo during their interest rate decision during the week. Bond yields dropped marginally as news around an oversubscribed SUKUK orderbook filtered into the market.

Nigerian Equities:

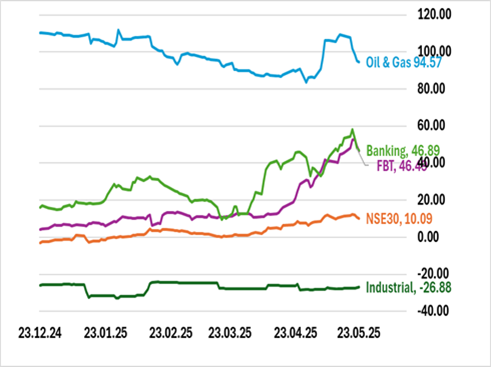

The All-Share Index retreated 0.62% due to selloffs in Oil & Gas, Banking and NSE30, recording -3.44%, -1.52% and -0.50% respectively. Heavy selling dominated the banking sector as premium tickers such as Fidelity, Access, and Zenith retreated in the week. Dual pressures from trade uncertainties and oil price declines have caused risk-off sentiments to prevail. We expect market activity to be subdued as clarity around the investment landscape develops.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 71.67 | 41.13 | 503.00 |

| Stop Rates | 18.00% | 18.50% | 19.56% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.45 | 19.45 | – |

| Feb-31 | 19.95 | 19.85 | 5 |

| May-33 | 19.95 | 19.90 | 5 |

| Jan-35 | 19.50 | 19.35 | 15 |

| Jun-53 | 17.00 | 17.00 | 0 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 07-May-26 | 19.55 | 19.20 | 23.69 |

| 23-Apr-26 | 19.40 | 19.20 | 23.47 |

| 09-Apr-26 | 19.80 | 19.50 | 23.97 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The DMO will be offering N200bn Nominal value of FGN Bonds at the Primary auction this week, retaping the 4yr and 8yr maturities; 19.30% 2029s (100bn) and 19.89% 2033s (100bn) respectively. Based on historical trend, we believe demand will be skewed to the longer maturity and will likely dictate the overall direction of yields in the secondary market.

Lastly, we anticipate liquidity from OMO maturity to kickstart activity at the short end of the curve while we keep an eye on the expected new OMO issuance; does the CBN continue with the mid end or revert to longer maturities.