Fixed Income in Focus:

Liquidity improved by ₦1.9tn, closing at ₦998bn, driven by NTB maturities, bond coupon payments, and FACC inflows. Monday’s bond auction saw higher stop rates of 19.00% and 19.99% on the reopened 29s and 33s. Investors locked in NTB rates, anticipating a slight decline against Wednesday’s auction, which saw a 31-bps drop (Bid-to-cover: 2.43). Despite improved liquidity, the market remained largely offered for the rest of the week as investors offloaded positions closing Q1 on a cautious note.

Nigerian Equities:

The ASI turned bullish this week cutting its losing streak with a 0.66% gain. Sentiment around the banking sector improved dramatically with the index registering a 5.61% gain, as investors position for the declared dividends of Tier 1 banks.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 38.65 | 24.27 | 745.80 |

| Stop Rates | 18.00% | 18.50% | 19.63% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.55 | 18.80 | 75 |

| Feb-31 | 19.84 | 19.55 | 29 |

| May-33 | 20.20 | 19.65 | 55 |

| Jan-35 | 18.90 | 18.70 | 20 |

| Jun-53 | 16.90 | 16.70 | 20 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 26-Mar-26 | 19.45 | 19.35 | 23.93 |

| 19-Mar-26 | 19.30 | 19.20 | 23.59 |

| 12-Mar-26 | 19.30 | 19.15 | 23.41 |

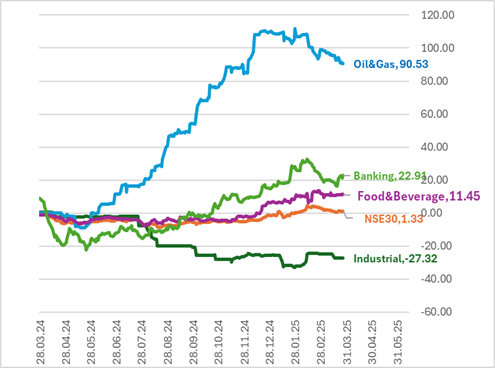

Indices Watch 1-Yr Performance %

This Weeks Market Movers

| Ticker | Close | Chg | Volume | Value |

| ₦ | % | ‘000 | ₦’Mill | |

| GEREGU | 1141.5 | 0.00% | 8,029 | 8,248.71 |

| ZENITHBANK | 47 | 3.07% | 155,490 | 7,412.84 |

| GTCO | 68.8 | 18.21% | 93,290 | 6,181.76 |

| UBA | 36.9 | -1.99% | 122,117 | 4,623.31 |

| ACCESSCORP | 22.35 | 1.13% | 205,005 | 4,541.58 |

| FIDELITYBK | 19 | 6.15% | 195,846 | 3,683.87 |

| NESTLE | 1020 | 4.62% | 3,547 | 3,584.67 |

| SEPLAT | 5700 | 0.00% | 695 | 3,562.89 |

| MTNN | 245 | 0.00% | 9,376 | 2,237.31 |

| PRESCO | 785 | 0.00% | 2,095 | 1,573.51 |

The Week Ahead…

Investors are closely watching for the release of the Q2 auction calendar, which could provide clarity on future issuances and influence positioning. As expectations build, investors may affirm their stance, leading to stronger demand and improved sentiment in the secondary market. Additionally, there is an increased likelihood of a CBN OMO auction to drain excess funds which could drive rates in the secondary market higher.