Fixed Income in Focus:

The week opened with the FGN bond PMA, where strong demand and tight allotments across the Apr 2029 and new Jun 2032 sparked profit-taking. This set a bearish tone, with yields initially declining before rebounding mid-week, particularly across the mid-curve. In the NTB space, the long-end paper dropped 50bps before closing at 17.60%, reflecting post-auction liquidity sentiment. OMO bills remained the top-yielding instruments, attracting firm demand. Money market was volatile, though liquidity held firm closing the week at ₦1.57tn.

Nigerian Equities:

The All-Share Index gained 1.57% to end the week at 119,995.76. Large moves were seen in Industrial, Consumer Goods and Banking stocks having each appreciated by 3.92%, 3.73%, and 2.59%, respectively. Palm oil sector rallied Presco and Okomuoil stocks as investors bet big on positive H1 earnings and demand for Presco’s N42 dividend. Banking sector held strong as banks reassured investors that there will be dividend payments this year.

Bond Auction Result

| 19.30% 2029 | 17.95% 2032 | |

| Sales (₦‘bn) | 1.05 | 98.95 |

| Marginal Rates | 17.75% | 17.95% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.58 | 18.30 | (72) |

| Feb-31 | 18.35 | 18.45 | (10) |

| May-33 | 18.30 | 18.40 | (10) |

| Jan-35 | 18.10 | 18.25 | (15) |

| Jun-53 | 16.35 | 16.45 | (10) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 18-Jun-26 | 18.05 | 17.60 | 21.20 |

| 04-Jun-26 | 17.75 | 17.50 | 20.88 |

| 19-Feb-26 | 19.00 | 18.75 | 21.30 |

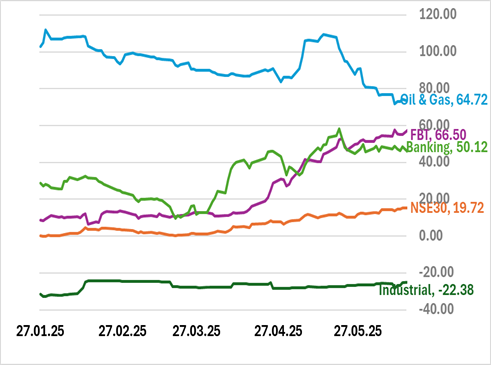

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with system liquidity strong at ₦1.57tn as at Friday’s close, with additional support expected from ₦23bn in Sukuk coupon payments on the FGNSK25s and FGNSK31s. With the Q3 auction calendar yet to be released, the market remains watchful, and current liquidity levels may prompt a potential OMO issuance by the CBN.

Focus now shifts to Monday’s Q1 GDP release, which could influence macro sentiment and curve positioning. In the interim, market direction will be shaped by CBN’s liquidity signals and timing of the upcoming auction calendar.