Fixed Income in Focus:

The CBN issued ₦600bn in OMO bills, clearing at 24% levels and maintaining status as the market’s highest-yielding instruments. NTB demand was muted, with the new 364-day bill pricing 51bps lower and closing at 18.10% driven by preference for OMO and a softer inflation outlook, as May CPI fell 74bps to 22.97%. Bond market activity focused on May 2033s and Feb 2031s, with yields dropping around 60bps on inflation-driven demand and positioning ahead of this week’s auction. The market ended quietly, with system liquidity rising to ₦180bn.

Nigerian Equities:

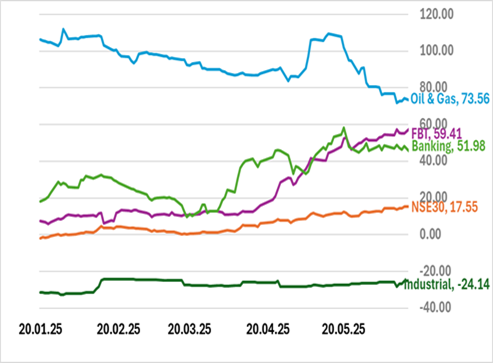

The All-Share Index appreciated 2.35% to end the week at 118,138.22 an All Time High. Bullish investors pushed the NSE30, Oil & Gas, FBT, and Banking a respective 2.33%, 5.27%, 2.16% and 3.58%. Despite a strong sell-off at the start of the week as investors grappled with CBN’s forbearance circular, the banking sector eventually rebounded with GTCO reaching all-time highs. Focus this week will be the banking sector and oil and gas sector developments.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 37.98 | 40.53 | 83.49 |

| Stop Rates | 17.80% | 18.35% | 18.84% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.15 | 19.02 | 13 |

| Feb-31 | 19.20 | 18.70 | 50 |

| May-33 | 19.40 | 18.80 | 60 |

| Jan-35 | 19.60 | 18.50 | 10 |

| Jun-53 | 16.90 | 16.72 | 18 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 18-Jun-26 | 18.25 | 18.10 | 22.02 |

| 04-Jun-26 | 18.20 | 18.10 | 21.84 |

| 22-Jan-26 | 19.05 | 18.80 | 21.10 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with the DMO offering ₦50bn in a new FGN Jun 2032 bond and ₦50bn in a reopening of the 19.30% FGN Apr 2029s. Supported by ₦499bn in inflows from NTB maturities and coupon payments (Jun 2038s and 2053s), system liquidity remains strong likely underpinning solid auction demand.

As the week progresses, focus will shift to the Q1 GDP release, which may shape macro sentiment and curve positioning. Auction outcomes and signals from the CBN on liquidity management will remain key to market direction.