Fixed Income in Focus:

The market reopened in a net liquid position of ₦420 billion after the extended break. Activity resumed with strong interest in the newly issued 4th June NTB, supported by expectations of inflows from maturing bills. OMO momentum continued, with the 20th January bill among the most traded, closing at a 27.05% effective yield. Bond activity was evenly spread across the curve, with notable demand for the May 2033s.With no major outflows and a shortened three-day trading week, system liquidity remained robust, closing at ₦963 billion.

Nigerian Equities:

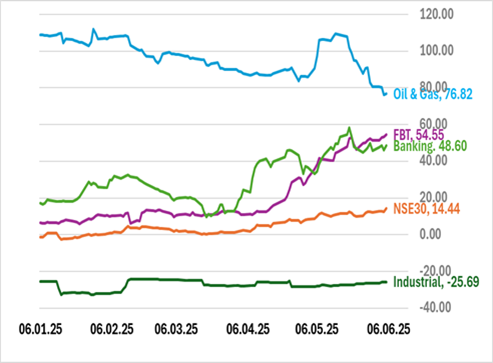

The All-Share Index continued its bull run to record a 2.57% gain this week. Strong buying interest prevailed though every sector with Banking, NSE30, and Oil & Gas indices leading the way registering 4.69%, 3.33%, and 2.45% respectively. Notably, trading volumes peaked for premium stocks on Thursday as investors rushed to grab value positions in MTNN, Access and GTCO. This likely solidifies a portfolio shift towards equities that should continue into another short trading week.

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.00 | 19.15 | (15) |

| Feb-31 | 19.30 | 19.18 | 12 |

| May-33 | 19.35 | 19.38 | (2) |

| Jan-35 | 18.60 | 18.45 | 20 |

| Jun-53 | 16.90 | 16.90 | – |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 04-June-26 | 19.05 | 18.85 | 23.04 |

| 07-May-26 | 19.00 | 18.80 | 22.57 |

| 05-Mar-26 | 19.30 | 19.15 | 22.19 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with key macro releases—May CPI and Q1 GDP—which are expected to guide investor sentiment. On the liquidity front, a net inflow of ₦1.021 trillion is anticipated from FGN Sukuk coupons and maturing OMO and NTB bills.

This precedes Wednesday’s NTB auction, where the DMO plans to issue ₦162 billion. Market tone will be shaped by the balance between system liquidity and auction demand, with macro data likely to influence yield direction. Early softness in rates is possible, but sentiment could shift midweek depending on inflation surprises and auction outcomes.