Fixed Income in Focus:

The week opened with a strong OMO auction, where the CBN matched demand at ₦1.5 trillion. NTB demand was also robust, but issuance remained tight, reinforcing the shift toward OMOs. Unmet demand at the NTB auction spilled into the secondary market, driving rates on the longer dated NTB to 18.80% post issue. OMO bills remained actively traded, with new issues yielding above 27%. Bond activity was led by the 2033s, with demand still concentrated on the long end of the curve. Liquidity remained net positive closed at ₦835billion.

Nigerian Equities:

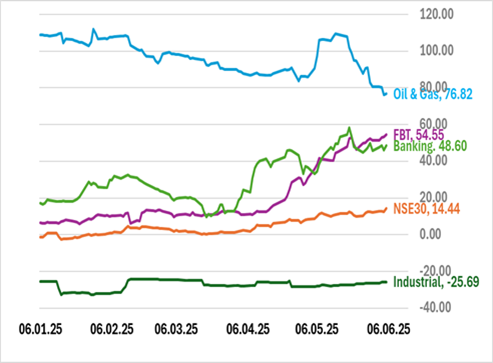

The All-Share Index continued its bull run to record a 2.57% gain this week. Strong buying interest prevailed though every sector with Banking, NSE30, and Oil & Gas indices leading the way registering 4.69%, 3.33%, and 2.45% respectively. Notably, trading volumes peaked for premium stocks on Thursday as investors rushed to grab value positions in MTNN, Access and GTCO. This likely solidifies a portfolio shift towards equities that should continue into another short trading week.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 50.00 | 30.031 | 369.968 |

| Stop Rates | 17.98% | 18.50% | 19.53% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.00 | 19.15 | (15) |

| Feb-31 | 19.30 | 19.25 | 5 |

| May-33 | 19.40 | 19.30 | 10 |

| Jan-35 | 19.80 | 19.50 | 30 |

| Jun-53 | 16.90 | 16.95 | (5) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 07-May-26 | 18.85 | 18.65 | 22.80 |

| 23-Apr-26 | 19.20 | 19.00 | 23.12 |

| 09-Apr-26 | 19.20 | 19.00 | 22.04 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

Markets resume this week against a backdrop of ₦346.1 billion in net inflows from OMO and NTB maturities. Following the Eid break and with Thursday set aside for Independence Day celebrations, the shortened trading week opens with no auctions scheduled.

In the absence of fresh supply, liquidity is expected to filter into the secondary market, with interest likely spanning across the curve with majority focus persisting on OMO bills. Activity may be shaped by reinvestment flows and positioning ahead of the next primary issuance window.