Fixed Income in Focus:

The week opened with a ₦771bn CBN OMO auction, clearing at 23.99% on the long end. Liquidity opened strong at ₦1.28tn but dropped to ₦588bn post-auction. Despite this, rate on the longer date issue fell by ~124bps signalling bullish sentiment and firm demand Mid-week activity slowed briefly as markets adjusted to the new two-way quote mandate, before picking up on the back of strong liquidity and H2 positioning. Bullish sentiment extended to bonds and NTBs, with focus on the FGN May 2033s, Jun 2053s, and long end NTBs like the 4-Jun and 5-Mar bills. Even with late-week tax remittances, liquidity held at ₦468bn, sustaining a positive tone.

Nigerian Equities:

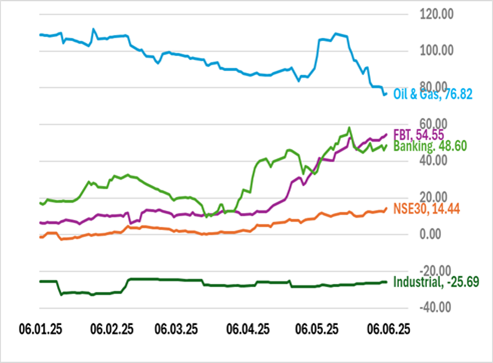

The All-Share Index continued its bull run to record a 2.57% gain this week. Strong buying interest prevailed though every sector with Banking, NSE30, and Oil & Gas indices leading the way registering 4.69%, 3.33%, and 2.45% respectively. Notably, trading volumes peaked for premium stocks on Thursday as investors rushed to grab value positions in MTNN, Access and GTCO. This likely solidifies a portfolio shift towards equities that should continue into another short trading week.

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 18.30 | 17.50 | 80 |

| Feb-31 | 18.35 | 17.40 | 95 |

| May-33 | 18.20 | 17.55 | 65 |

| Jan-35 | 17.00 | 16.50 | 50 |

| Jun-53 | 16.53 | 15.75 | 78 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 04-Jun-26 | 17.75 | 17.50 | 20.84 |

| 05-Mar-26 | 18.65 | 18.20 | 20.71 |

| 19-Feb-26 | 19.10 | 18.85 | 21.38 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens on a quiet macro note, with no major economic data releases expected. Attention is shifting to the NTB market, where activity is expected to pick up as investors begin positioning ahead of a potential auction, despite the absence of a published Q3 issuance calendar.

System liquidity remains positive and is set to receive an additional boost from a ₦301bn NTB maturity, which should support demand across the curve. Unless offset by an unexpected OMO auction or large fiscal debit, the market is likely to maintain a firm tone, with interest concentrated on the mid-to-long end.