Fixed Income in Focus:

The week opened positive with ₦275bn in system liquidity and a bullish tone. The CBN’s mid-week OMO auction saw ₦1.25tn sold at over 200bps below prior stop rates, followed by an NTB auction that also cleared sharply lower +200bps across tenors reinforcing a dovish shift in yield expectations. Demand spilled into the secondary market, with the new 364-day bill trading ~100bps lower. Bonds remained active, particularly the May 2033s and Feb 2031s, which attracted strong bids as yields compressed further. Liquidity closed the week tighter at a negative ₦118bn.

Nigerian Equities:

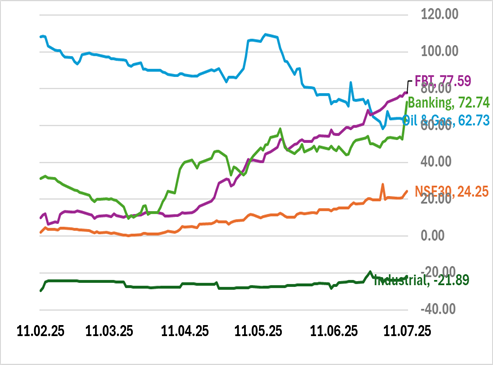

The All-Share Index continued its bull run to record a 2.57% gain this week. Strong buying interest prevailed though every sector with Banking, NSE30, and Oil & Gas indices leading the way registering 4.69%, 3.33%, and 2.45% respectively. Notably, trading volumes peaked for premium stocks on Thursday as investors rushed to grab value positions in MTNN, Access and GTCO. This likely solidifies a portfolio shift towards equities that should continue into another short trading week.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 59.84 | 15.66 | 126.30 |

| Stop Rates | 15.74% | 16.20% | 16.30% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.00 | 16.40 | 60 |

| Feb-31 | 17.62 | 16.65 | 97 |

| May-33 | 17.50 | 16.60 | 90 |

| Jan-35 | 16.60 | 16.60 | – |

| Jun-53 | 15.80 | 15.90 | (10) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 09-Jul-26 | 15.45 | 15.30 | 18.03 |

| 19-Feb-26 | 16.90 | 16.45 | 18.27 |

| 22-Jan-26 | 16.80 | 16.40 | 17.95 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens on the back of a negative system liquidity balance, with no scheduled auctions and only modest support expected from a ₦64.8bn coupon inflow on the FGN July 2034s.

Attention turns to Tuesday’s June inflation print, where expectations of a continued disinflationary trend are reinforcing dovish sentiment. In the absence of fresh supply, trading is likely to remain cautious and data-driven, with curve positioning shaped by CPI outcomes and any liquidity signals from the CBN.