Fixed Income in Focus:

The week opened on a cautious, liquidity-tight footing as CRR debits and FX settlements drained cash, flipping system balance from ₦313.9bn long to a ₦94.6bn deficit by Friday. NTB interest stayed skewed to the long end, with 6-Aug and 23-Jul leading prints. OMO supply remained heavy, with 7-Apr anchored around 27.39% yield. Bearish tone persisted in FGN bonds; the mid-curve stayed under pressure, with the Feb-31s and May-33s dominating activity. The DMO revised the Q3 calendar signalling heavier supply in the upcoming bond auctions. Positive inflation developments closed the week, with headline CPI declining 34bps y/y, signifying modest disinflation despite a 31bps m/m increase.

Nigerian Equities:

The All-Share Index retreated 0.77% to close the week lower at 144,628.20. Bears dominated traded desks as investors sought to take profits from the long market rally. Most sectors closed the week lower, but the Insurance sector gained 8.21% despite a market reversal late in the week. We still expect buying opportunities to present themselves and investors should exercise caution in their stock-picking.

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.00 | 16.90 | 10 |

| Feb-31 | 16.90 | 17.40 | (50) |

| May-33 | 16.85 | 17.35 | (50) |

| Jan-35 | 16.50 | 16.50 | 0 |

| Jun-53 | 15.90 | 15.95 | (5) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 06-Aug-26 | 16.25 | 16.05 | 19.02 |

| 23-Jul-26 | 16.10 | 16.00 | 18.81 |

| 20-Nov-25 | 17.00 | 16.50 | 17.23 |

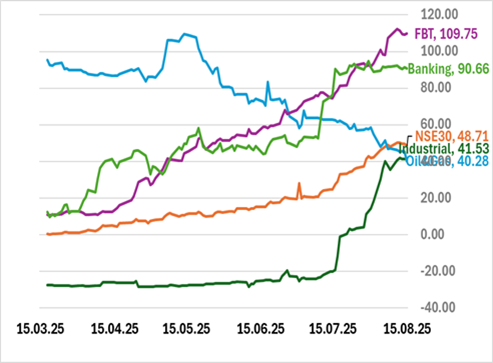

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with a liquidity lift from ₦951bn in NTB maturities, coupon payments on the FGN 2034 and 2031 bonds, and an OMO maturity. With no early macro catalysts, activity is likely to be shaped by secondary-market flows and positioning ahead of the NTB auction, where the DMO plans to issue ₦230bn across tenors.

Against this backdrop, we expect a cautious bidding tone, with stop rates likely to print above the previous auction in line with secondary market pricing. Demand should be firmer for the long bill, while the front end remains supported by inflows.