Fixed Income in Focus:

The market opened net long as under-allocation at the bond auction redirected demand into the secondary market. The 2032s repriced +210bps to 18.00% from the last print, while the new 2030s closed at 17.95%. Consequently, yields at the belly of the curve dipped about 30bps to close 17.55%-17.70% Mid-week, the CBN reopened the 18-Nov OMO twice, clearing at 28.21% and 28.19% effective yields. NTB activity remained relatively muted as we saw significant offers on the Mar – April maturities at 17.5% discount rate. Liquidity closed positive at ₦1.402tn.

Nigerian Equities:

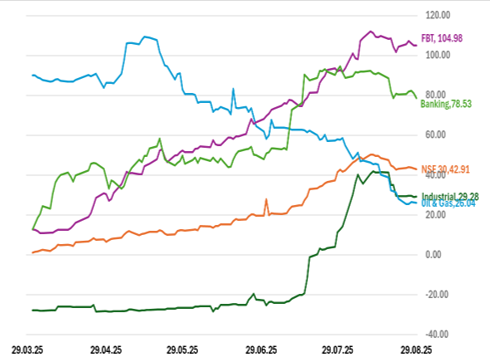

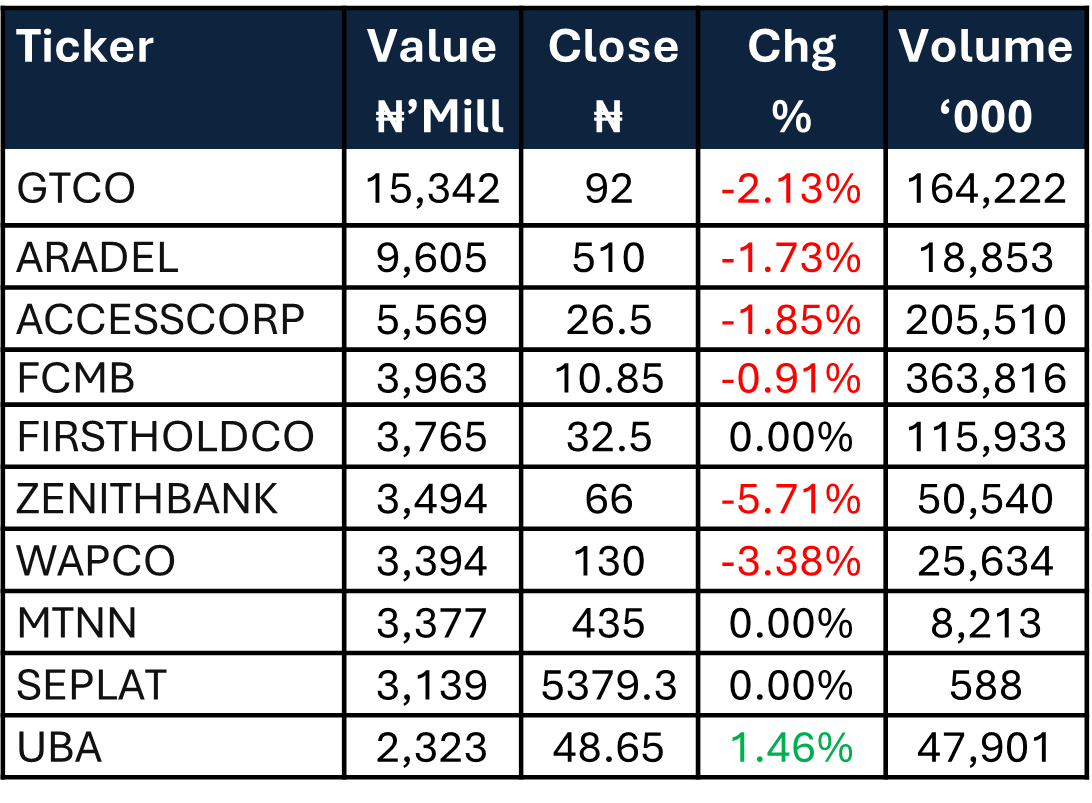

The ASI fell marginally lower, 0.5%, to end the week at 140,295.50. The tail end of this month was driven by the bears with NSE30 closing lower 0.38% m-o-m. While industrials and insurance sectors keep their m-o-m gains, that was threatened by weak sentiments as each lost 0.36% and 1.02% respectively for the final week of August. Chinese investors take over WAPCO and investors are focusing attention on upcoming banking H1 result releases which may slow profit taking.

Bond Auction Result

| 17.945% 2030 | 17.95%2032 | |

| Sales (₦‘bn) | 46.005 | 90.157 |

| Marginal Rates % | 17.945% | 18.00% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.30 | 17.75 | (45) |

| Feb-31 | 18.00 | 17.70 | 30 |

| May-33 | 17.90 | 17.55 | 35 |

| Jan-35 | 17.00 | – | – |

| Jun-53 | 16.45 | 15.90 | 55 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 20-Aug-26 | 17.20 | 17.00 | 20.28 |

| 12-Mar-26 | 17.70 | 17.25 | 18.98 |

| 05-Mar-26 | 17.70 | 17.30 | 18.97 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

We expect the NTB auction this week to set the tone for direction of yields. Since the last NTB Primary Market Issuance, secondary market has traded sideways with a bearish undertone driven by overall bearish sentiments and the possibility of higher issuances going forward.

However, the recent pattern of OMO issuances (less than 100 days Tenor TO Maturity) by the CBN could drive new interest for 270-364day bills going forward as fund managers lock in superior yields before the expected rate cut later this month.