Fixed Income in Focus:

The fixed income market opened the week on a relatively bearish note, with investors positioning ahead of the mid-week NTB auction. The auction cleared at 21.12% effective yield, about 136bps higher than the previously issued 365-day bill. Following this, the CBN conducted an OMO auction to absorb surplus liquidity, with stop rates at 27.19% (89-day)and 28.51% (124-day). The FGN bond market also closed bearish across the curve, with the mid-tenor 2031s and 2033s seeing the most activity. Sentiment was largely shaped by dovish expectations for the upcoming bond auction. System liquidity remained in surplus, ending the week at ₦287bn.

Nigerian Equities:

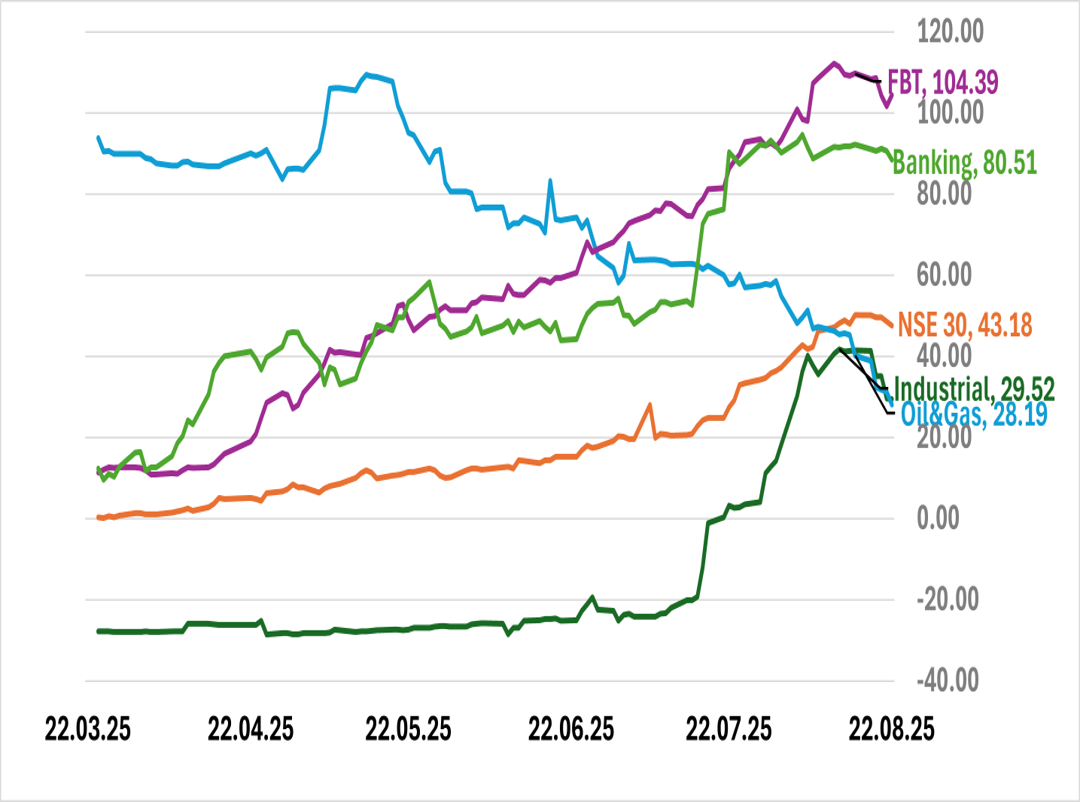

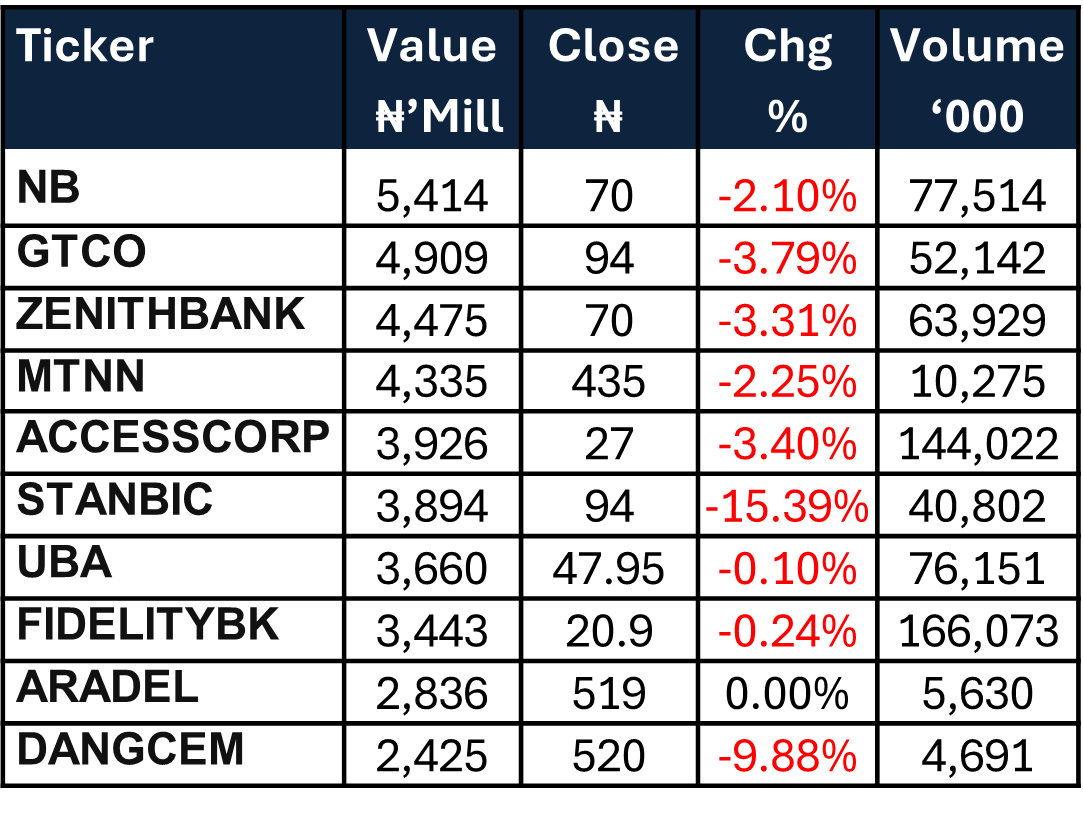

The All-Share Index continues its correction closing at all-time high of 141,004.14, declining 2.51% this week. Industrials led the sell off with an 8.42% loss as DANGCEM, BUACEMENT and WAPCO anchor the sector lower. Sell-offs extended to every sector aside from consumer goods which posted a moderate 0.83% gain. We forecast deeper discounts as investors reposition portfolios.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 7.703 | 27.703 | 268.382 |

| Stop Rates | 15.35% | 15.50% | 17.44% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 17.30 | 17.30 | 0 |

| Feb-31 | 17.65 | 18.00 | (35) |

| May-33 | 17.30 | 17.65 | (35) |

| Jan-35 | 16.60 | 17.00 | (40) |

| Jun-53 | 16.00 | 16.45 | (45) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 20-Aug-26 | 16.75 | 17.25 | 20.80 |

| 23-Jul-26 | 16.15 | 16.80 | 19.84 |

| 19-Mar-26 | 17.00 | 17.35 | 19.24 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with a bond auction, where the DMO is expected to issue ₦200bn across a new FGN AUG 2030 and a re-opening of the FGN JUN 2032. Investor demand at the sale will provide the first signal for yield direction and shape activity in the secondary market.

System liquidity is expected to be supported by about ₦415bn in inflows from the FGN 2028 coupon payment and maturing OMO bills, which should aid participation and guide market direction through the week. Q2 GDP data is also due early in the week, but liquidity conditions and auction outcomes will remain the key drivers of sentiment.