Fixed Income in Focus:

The banking system opened the week liquid at ₦374 billion, rising by ₦1.4 trillion to close the week at ₦1.7 trillion. The NTB secondary market saw balanced sell-offs as investors repositioned ahead of Wednesday’s auction, which cleared at significantly lower stop rates. The bond market stabilized, with the 2031s and 2033s leading trading activity. Amid the liquidity surplus and limited NTB supply, the CBN announced an OMO auction to absorb excess funds and support a slight lift in yields. OMO bills continued to trade dominantly at 22% levels to close the week.

Nigerian Equities:

ASI gained an impressive 1.46%, while Food & Beverage, Banking, and Insurance closed bullish each registering a weekly gain of 8.65%, 5.06% and 7.30%, respectively. WAPCO announced special interim dividend of N4 as cement manufacturers post strong Q1 earnings. Bullish sentiment expected to continue into next week with more earnings releases on the way.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 51.37 | 12.72 | 650.28 |

| Stop Rates | 18.00% | 18.50% | 19.60% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 18.50 | 19.00 | (50) |

| Feb-31 | 20.15 | 19.95 | 20 |

| May-33 | 20.00 | 19.95 | 5 |

| Jan-35 | 19.45 | 19.45 | 0 |

| Jun-53 | 17.00 | 16.90 | 10 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 23-Apr-26 | 19.50 | 19.30 | 23.85 |

| 9-Apr-26 | 19.40 | 19.15 | 23.41 |

| 26-Mar-26 | 19.35 | 19.10 | 23.13 |

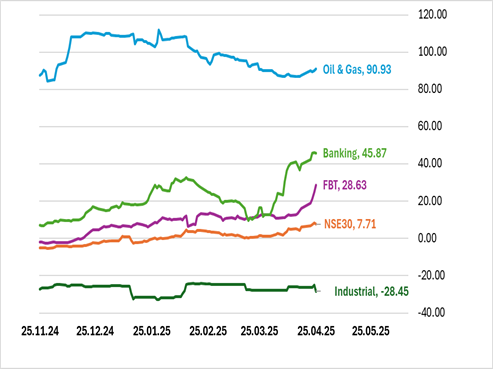

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

Focus is shifting to the upcoming FGN bond auction on Monday. Caution largely persists in the secondary market despite the near liquid position. With a large supply on offer and liquidity conditions yet to be confirmed, bidding behavior will be closely watched for signs of market appetite

Secondary market activity is likely to remain cautious ahead of the auction, with broader direction dependent on auction results and system liquidity trends early in the week.