Fixed Income in Focus:

Liquidity opened at ₦906bn and closed the week at ₦303bn. The market remained largely offered, weighed down by geopolitical tensions and a delayed auction notice. Yields rose early in the week, with OMO bills reaching 24%, while FPI sell pressure drove NTB yields above previous stop rates. Despite strong demand, the auction cleared below expectations, muting participation. Toward week’s end, interest shifted to previously issued bills as investors sought to fill unmet demand, helping ease yields slightly.

Nigerian Equities:

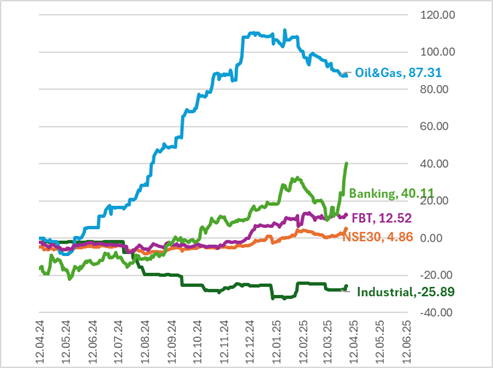

Asset managers faced a volatile week as global sell offs spilled into the NGX with the ASI losing 0.9%. All indices closed red as FPIs dumped local securities in their flight to safety. Notably, dividend seekers returned late, and we expect continued interest into next week’s dividend qualification dates for Tier 1 Banks.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 111.81 | 105.78 | 206.97 |

| Stop Rates | 18.50% | 19.50% | 19.63% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.40 | 19.50 | (10) |

| Feb-31 | 19.65 | 20.05 | (40) |

| May-33 | 19.80 | 20.00 | (20) |

| Jan-35 | 18.95 | 19.30 | (35) |

| Jun-53 | 17.00 | 16.80 | 20 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 9-Apr-26 | 19.40 | 19.10 | 23.55 |

| 26-Mar-26 | 19.45 | 19.40 | 23.80 |

| 19-Mar-26 | 19.50 | 19.40 | 23.69 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

No auction, but we expect moderate demand in the secondary market as investors gain more clarity on the fiscal position. March CPI may be released this week and negotiations with US over trade policy are ongoing.

In addition, a ₦220 billion bond coupon inflow is expected to add to an already net positive system liquidity. While these factors may not fully restore investor confidence, they could reduce the urgency to offload positions.