Our latest report analyzes Nigeria’s proposed $5 billion oil-backed loan with Aramco, highlighting the liquidity boost it offers, the strain of rising crude commitments, and the broader fiscal risks tied to price volatility and output shortfalls.

Key Points

- Nigeria’s external financing gap for 2025 stands at $21.5 billion, with the $5B Aramco oil-backed loan proposed to help plug it.

- Over 400,000 bpd of crude is now committed to debt servicing, limiting Nigeria’s flexibility amid OPEC+ supply hikes and output underperformance.

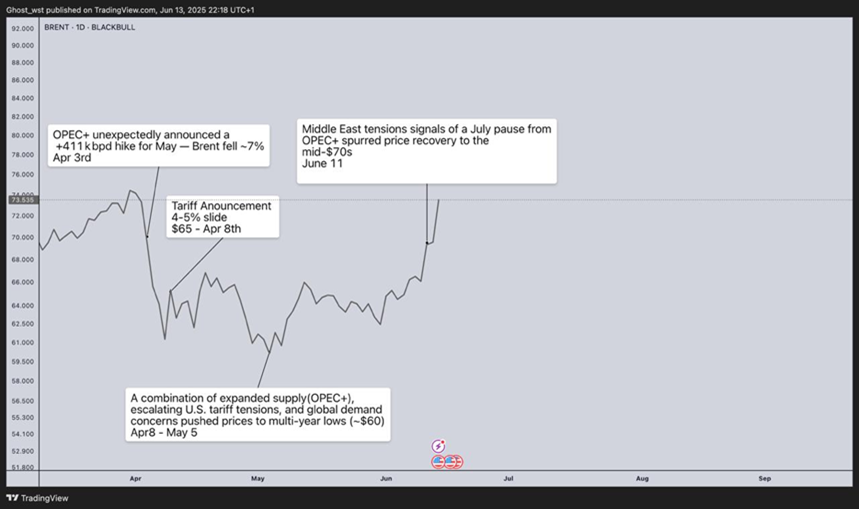

- Crude prices dropped ~$25/bbl. following OPEC+’s May 2025 production hike, weakening oil-backed revenue potential and exposing Nigeria to delivery and budget risks.

The Promise of Oil-Backed Liquidity

In November 2024, Nigeria entered formal negotiations with Saudi Aramco for a $5 billion oil-backed loan—the largest of its kind in the country’s history. The proposal: pledge 100,000 barrels per day (bpd) of crude oil in exchange for immediate cash. Structured as a forward sale, the deal echoes similar instruments used during past liquidity crises, designed to support Nigeria’s foreign reserves and plug budget deficits. The loan is intended to help close Nigeria’s $21.5 billion external financing gap for 2025. So far, only a fraction of this amount has been secured—including a $925 million disbursement under Afreximbank’s Project Gazelle. This leaves a financing gap of approximately $15–17 billion, intensifying the urgency of finalizing the Aramco arrangement.

The deal has been delayed due to:

• Oil price volatility, which affects loan servicing terms

• Overlapping crude commitments, with 300,000 bpd already tied to other facilities

• Nigeria’s limited spare capacity, which makes fulfilling new delivery obligations difficult

The Weight of Old Debt

Nigeria already has multiple oil-backed debt arrangements in motion.

| Facility | Amount | Collateral | Terms |

|---|---|---|---|

| Project Gazelle I (Afreximbank) | $3.3B | 90,000 bpd | $3.175B disbursed by June 2024; 11–11.8% interest; 6% margin; 0.5% liquidity premium |

| Legacy Oil-Backed Facilities | – | 300,000 bpd | Repaid through rolling 90-day crude cargo deliveries |

According to ThisDay reporting, Nigeria’s national oil company NNPC has committed over $21.5 billion in forward oil sales since 2019, with a repayment structure that hobbles flexibility in allocating domestic crude. Over 300,000 bpd—more than one-third of Nigeria’s total production—is already locked into existing repayment deals. Adding the Aramco loan’s 100,000 bpd commitment would push Nigeria’s crude-backed debt service to ~400,000 bpd, straining export buffers.

The OPEC+ Quota Squeeze

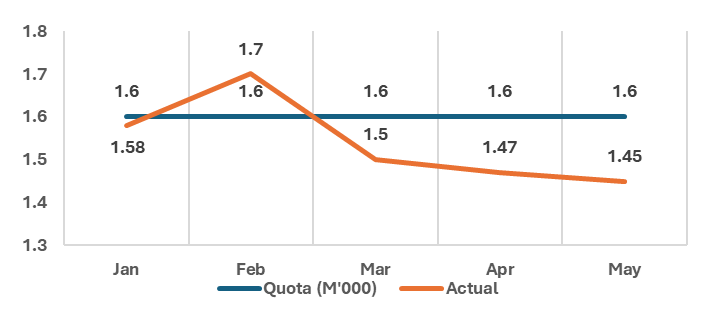

In April 2025, OPEC+ announced that it would raise collective output by 411,000 bpd monthly starting in May, rolling back previous voluntary cuts. Nigeria’s assigned quota for Q2 2025 was set at 1.58–1.6 million bpd, consistent with prior months.

According to the May 2025 OPEC Monthly Oil Market Report:

• OPEC-reported production: 1.38 million bpd

• Government-reported production: 1.45 million bpd

• Including condensates: ~1.63–1.7 million bpd

Nigeria’s Crude Oil Production vs OPEC Benchmark (Jan-May 2025)

The Market Share Game

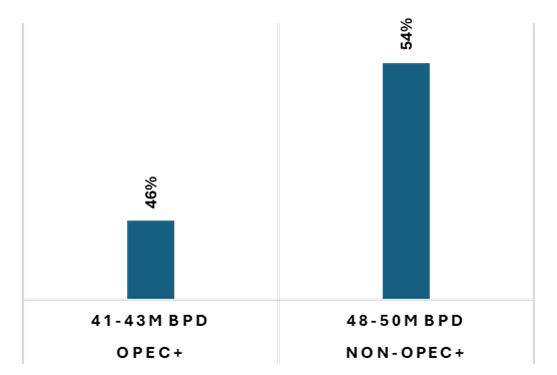

OPEC+ is at a strategic inflection point. Once the unchallenged steward of global oil supply, its grip on market dominance is steadily loosening. This trend has profound implications not only for the bloc’s cohesion and leverage but also for its individual members—especially those, like Nigeria, that are struggling to meet internal targets.

Declining Share in a Growing Market:

According to the EIA and the May 2025 OPEC Monthly Oil Market Report:

• In 2016, OPEC+ held a commanding 53% share of global crude production.

• By 2025, that share has shrunk to approximately 46%, despite quota expansions.

Crude Oil Market Share OPEC+ VS Non-OPEC+

What is Driving the Shift

• U.S. Shale: Fast, flexible production from U.S. shale—especially the Permian Basin has added ~13.2m bpd to global supply.

• New Entrants: Brazil, Canada, and Guyana continue ramping up deepwater and unconventional output.

• Internal Misses: Several OPEC+ members, including Nigeria, are underdelivering on quotas.

• Buyer Strategy: Importers like China and India are diversifying away from OPEC reliance.

Why It Matters For Nigeria

Oil-backed loans, like the proposed $5 billion Saudi Aramco deal, tie Nigeria’s debt servicing capacity directly to its crude oil output and global oil prices. While they provide upfront liquidity, they expose the country to commodity-linked fiscal volatility. If Nigeria commits to delivering a fixed volume of oil (e.g., 100,000 bpd) under the Aramco agreement, it must meet that obligation regardless of market conditions. This creates several layers of macroeconomic and credit risk:

• Revenue Erosion: When global oil prices fall, the dollar value of each barrel Nigeria delivers drops. For example, at $85/bbl., 100,000 bpd yields $8.5 million daily. At $60/bbl., that figure drops to $6 million. However, Nigeria still owes the same number of barrels, eroding potential fiscal gains or foreign reserves.

• Delivery Shortfalls: Nigeria’s underperformance against OPEC+ quotas (recently producing ~1.38m–1.45m bpd vs. a 1.6m bpd target) means it may struggle to deliver pledged volumes. If it fails to meet its contractual obligations, the loan terms could be renegotiated unfavourably, delayed, or even lead to legal penalties or reputation loss.

• Budget Risk: Nigeria’s 2025 national budget is based on an oil price benchmark of $75/bbl., but it’s true fiscal breakeven (BEP)—the oil price needed to balance the budget—is estimated at over $130/bbl. Any sustained price below $75 exacerbates budget deficits, especially when combined with fixed oil repayment obligations.

• Credit Downgrade Triggers: If Nigeria is perceived as overleveraged and under-delivering on oil contracts, it could trigger negative outlooks from ratings agencies like Moody’s, Fitch, or S&P. This would increase the cost of borrowing and dampen investor confidence—especially critical as Nigeria tries to close a $21.5 billion external financing gap.

Crude Oil Price Activity Chart Apr-June 2025

Caution Wrapped in Urgency

The Aramco oil-backed loan may plug a critical short-term funding hole, but it also deepens Nigeria’s long-term exposure to oil market volatility. As OPEC’s market power wanes and Nigeria struggles to meet production targets, tying debt obligations to crude output amplifies sovereign risk. Any further price shocks or delivery failures could undermine both fiscal stability and investor confidence. For this deal to be worth the barrels, Nigeria must ensure delivery capacity, pricing flexibility, and above all strategic foresight.

Kindly find the Report Below

Thanks for reading.