Our latest report breaks down the new local content directive under Tinubu’s administration, exploring its potential to reshape public procurement, revive domestic industry, and avoid the pitfalls of past protectionist policies.

Key Points

- President Tinubu’s new executive order mandates that all government procurement prioritize Nigerian-made goods and services.

- The directive is designed to curb unnecessary imports, boost domestic production, and mandate technology transfer when foreign suppliers are used.

- The Bureau of Public Procurement (BPP) will oversee compliance, including maintaining a registry of local vendors and requiring waivers for any foreign purchases.

New Era of Local Content and Industrial Rebirth

In a defining policy shift, President Bola Ahmed Tinubu has introduced the “Renewed Hope: Nigeria First Policy” a bold move that places Nigerian industries and local content at the centre of government procurement and spending. Approved by the Federal Executive Council (FEC) and soon to be backed by a formal executive order.

The Policy is designed to:

• Stimulate local production

• Reduce import dependency, and

• Restore national economic sovereignty.

The announcement comes at a crucial time. Despite having untapped capacity across sectors like sugar, textiles, and steel, Nigeria still relies heavily on imports. The new policy challenges this by mandating that public funds prioritize local industry foreign procurement and will only be allowed if no viable Nigerian alternative exists. More than a procurement reform, this is a strategic move to reshape Nigeria’s economy, boost jobs, and build self-reliance. The Attorney General has been directed to draft an executive order to give the policy full legal force.

| Key Directive | Explanation |

|---|---|

| 1) Local Content First in Public Procurement: | All government Ministries, Departments, and Agencies (MDAs) must prioritize Nigerian-made goods and services. Procurement from abroad is strictly prohibited unless a written waiver is secured from the Bureau of Public Procurement (BPP). This ensures local producers are the first option in every contract. |

| 2) Revised Procurement Guidelines: | The BPP is to update its procurement regulations to reflect this new local-first policy. This includes setting up checks, enforcement mechanisms, and capacity-building plans to help MDAs comply effectively. |

| 3) National Supplier Registry: | The BPP will maintain a centralized register of certified Nigerian manufacturers and service providers. Only vendors on this list will be eligible for federal contracts, ensuring quality control and improved traceability in government spending. |

| 4) Recalled Procurement Officers: | All procurement officers assigned to MDAs will now report directly to the BPP, not their individual agencies. This reform is aimed at reducing undue influence and fostering uniformity and accountability |

| 5) Technology Transfer for Imports: | If a foreign vendor is necessary, contracts must include provisions for local value via technology transfer or domestic production. |

| 6) Mandatory Procurement Plan Review: | All MDAs must review and revise existing procurement plans to comply with the new rules. Non-compliance may lead to sanctions or contract cancellations. |

Why It Matters

This policy is about reshaping how the Nigerian government spends. Rather than exporting wealth through imports Tinubu’s administration wants to redirect that value into Nigerian factories, workers, and industries. It signals a return to economic nationalism,

With Focus on:

•Domestic resilience,

•Self-belief, and

•Reducing capital flight.

In doing so, it also challenges MDAs to think strategically about long-term development, not just short-term contracts. As this executive order takes hold, it could redefine the landscape for manufacturers, suppliers, and entrepreneurs while also laying the groundwork for *sustainable industrialization and economic dignity.

Nigeria’s Protectionist History, Key Lessons and Consequences

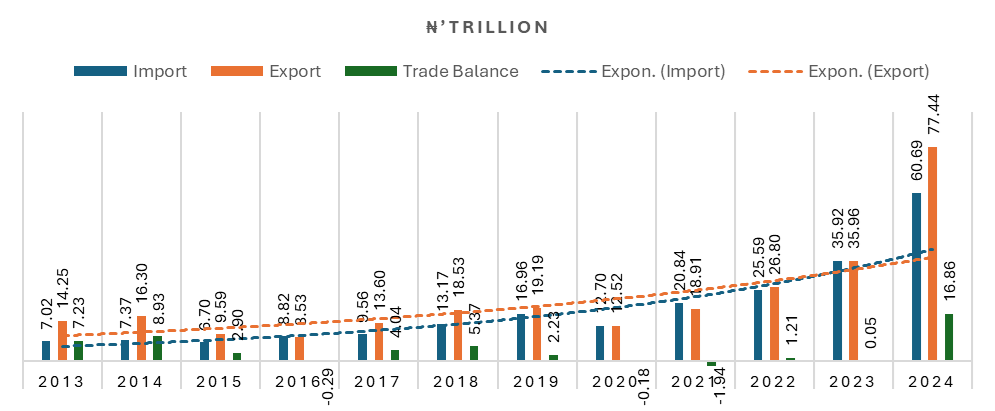

Nigeria’s history with protectionist policies is not new. From the 2008 Import Prohibition List to the 2015 CBN foreign exchange restrictions, prior efforts to promote local industry achieved only fleeting success. Smuggling rose, inflation spiked, and domestic manufacturing remained underpowered. The table below summarizes key lessons from these past interventions.

| Theme | Lessons from the Past | Results and Impacts |

|---|---|---|

| 1) Policy Design & Enforcement | Previous bans lacked lasting legal force (2008 Import Prohibition List) No centralized oversight or capacity building mechanisms | Negative: Loopholes and poor enforcement led to policy circumvention and noncompliance (2008-2010) |

| 2) Trade & Smuggling | Trade restrictions reduced official imports but failed to curb overall consumption (2015 CBN restriction) | Positive: Imports dropped (e.g., from N7.37tn in 2014 to N6.70bn in 2015). Negative: Smuggling surged by 70%, weakening trade control. |

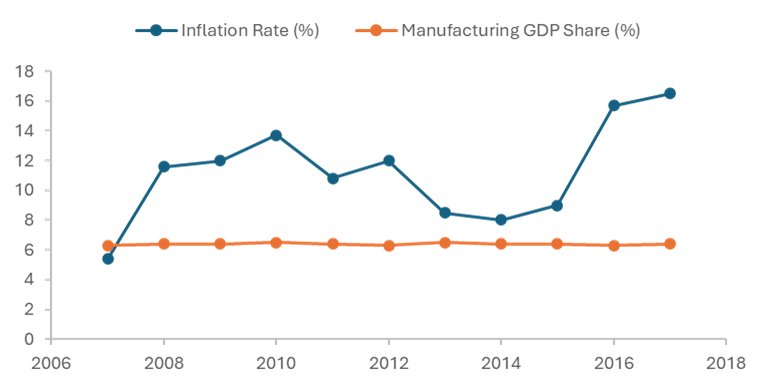

| 3) Inflation & Consumer Impac | Demand-side pressure and weak supply chains triggered price instability. | Negative: Annualized Inflation rose from 5.4% to 11.6% after the (2008) ban. Negative: Similar spikes followed FX restrictions. Inflation rose from 8.0% (2015) to 15.7% (2016) |

| 4) Manufacturing & Industrial Output | Industrial base was too weak to scale up in response. | Negative: Imports rebounded (to N15.7bn by 2016), and trade surpluses eroded. Negative: Underlying oil dependency remained unchanged |

| 5) Sustainability of Gains | Import declines were temporary and reversed by 2017. | Negative: Imports rebounded (to N15.7bn by 2016), and trade surpluses eroded. Negative: Underlying oil dependency remained unchanged. |

Trade Data Snapshot:

Annualized Inflation vs Manufacturing GDP Share (2007-2017)

This comparison shows how inflation spiked during key protectionist periods (like post-2008 and post-2015), while the manufacturing sector’s share of GDP remained largely stagnant around 6.4%. Would you like this chart exported for use in your article or presentation?

The Promise of “Nigeria First”: What’s Different Now?

Unlike earlier measures, the Nigeria First policy is backed by executive authority and structural enforcement. It signals a more integrated, long-term push to rebuild Nigeria’s industrial backbone, starting with how government spends. If implemented with discipline, it could finally address the systemic cracks that undermined past efforts. Below is a summary of the improvements and why they may offer a different outcome.

| Improvement Area | Policy Enhancement | Potential Benefit |

|---|---|---|

| 1) Legal Backing | Executive order ensures enforceability across MDAs. | Provides legal clarity and strengthens compliance. |

| 2) Oversight Structure | Centralized waivers managed by the Bureau of Public Procurement (BPP). | Reduces discretion, enhances transparency, and limits abuse. |

| 3) Technology Transfer | Mandatory local value clauses in foreign contracts. | Promotes skills development and reduces long-term dependency. |

| 4) Procurement Reform | MDAs must align plans with new rules or face sanctions. | Embeds accountability and shifts incentives toward local sourcing. |

The road ahead requires more than bold policy declarations, it demands consistency, coordination, and credibility. If current reforms are to succeed where others faltered, implementation must be disciplined, data-driven, and aligned with long-term national priorities. Only then can Nigeria turn policy ambition into tangible progress.

Kindly find the Report Below

Thanks for reading.