Get ahead of market shifts with our Q2 2025 Market Outlook. Analyze US-China trade war effects, asset volatility, and top investment strategies for navigating uncertainty.

Discussion Points

- Global Trade Tensions: Impact of the U.S.-China trade war and escalating tariffs on global markets.

- Equity Market Reactions: Global and domestic markets response to tariff volatility.

- Oil Market Impact: The effect of trade tensions on global oil production.

Trade Wars and the Burden of Deficits

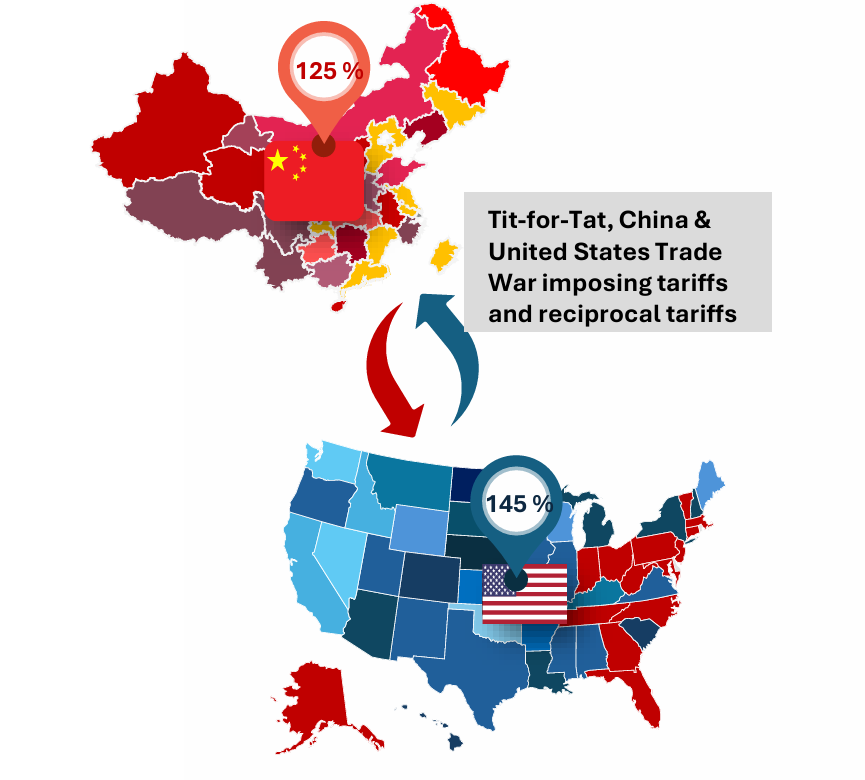

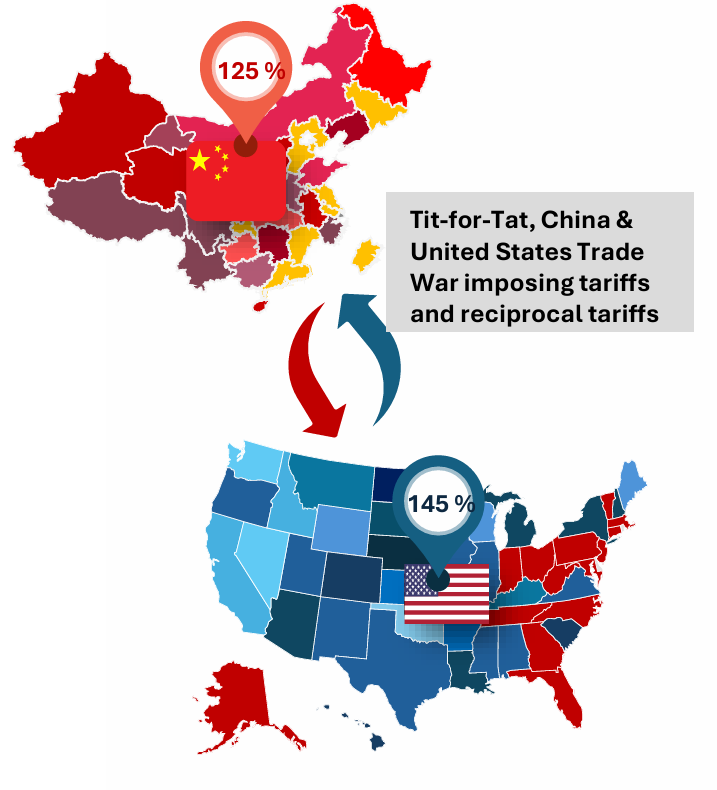

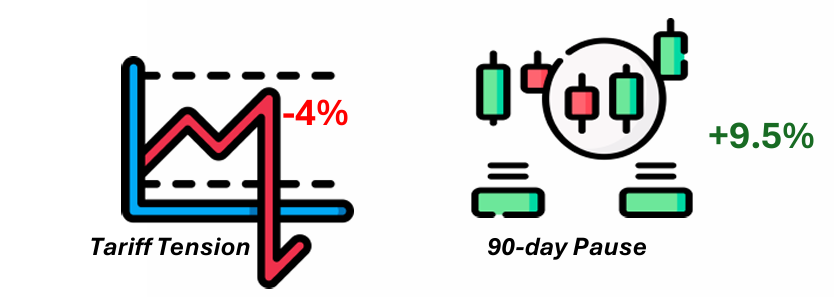

Global trade is entering a new era where tariffs act as geopolitical tools. On April 2, 2025, the U.S. imposed a 10% baseline tariff on most imports, excluding close allies. China retaliated with a 34% tariff on U.S. goods, followed by further escalations: the U.S. raised tariffs to 145%, and China responded with 125%, effective April 12. Although the U.S. introduced a 90-day pause on non-China tariffs on April 9, global markets had already reacted sharply.

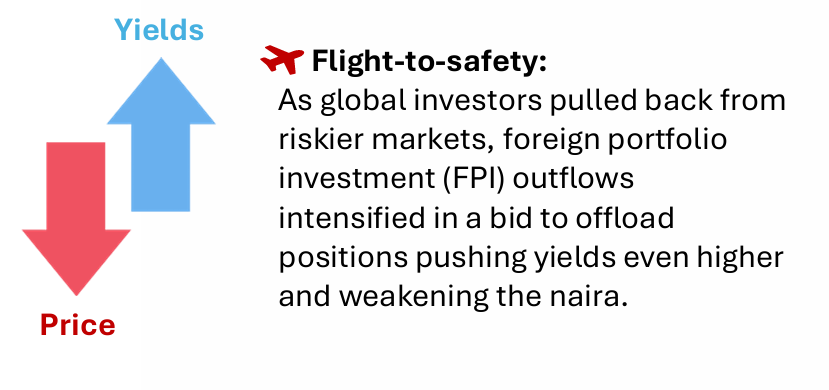

The S&P 500 briefly surged 9.5% in response, but this was preceded by a significant sell-off, with the index down nearly 4% in the days prior. Investor optimism quickly faded as fears of a sustained trade standoff resurfaced. Treasury yields climbed, credit spreads widened, and emerging market currencies came under pressure signaling broad risk-off sentiment.

Nigeria felt the shockwaves as Eurobond yields soared, raising borrowing costs and reflecting heightened risk aversion among investors. The U.S. further imposed a 14% tariff on Nigerian exports, despite Nigeria’s $1.4 billion trade surplus in 2024, citing import restrictions on several American goods. While Nigeria recorded a ₦3.42 trillion trade surplus in Q4 2024, largely driven by oil exports, the economy remains exposed. Without diversification, policy clarity, and deeper AfCFTA integration, these gains may prove short-lived.

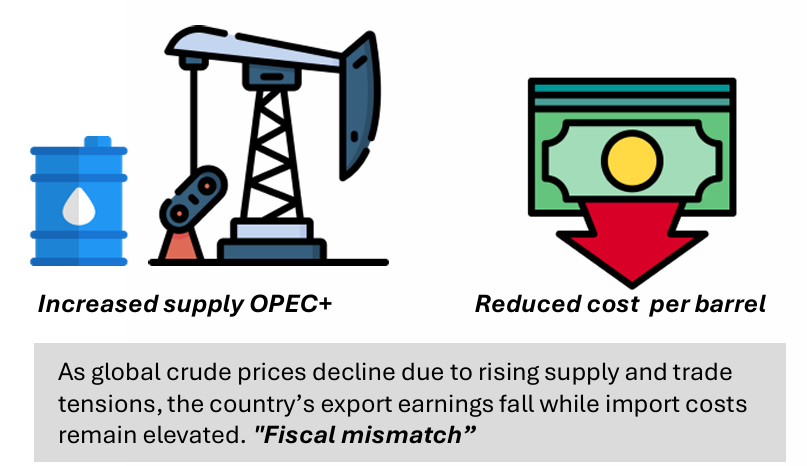

Crude Consequences: The Ripple

In Q4 2024, Nigeria averaged 1.54 million barrels per day in oil production, just shy of its OPEC quota, due to pipeline sabotage and infrastructure gaps. By April 2025, Brent crude fell to $63 per barrel down over 15% as oversupply and the U.S.-China trade row hit prices. With oil still central to Nigeria’s budget, the revenue loss is significant. Nigeria relies on imports for refined fuel, pushing up local costs and straining public finances. As OPEC+ weighs increased production, Nigeria must juggle short-term targets with deeper fiscal reforms.

Kindly find the Report Below

Thanks for reading.