Weekly Market Report: December 8 – 12th, 2025

Fixed Income in Focus: The week opened firm, with system liquidity at c.₦3.6tn, even as bearish sentiment dominated early activity. In the Treasury market, profit-taking ahead of the mid-week NTB auction drove early positioning; the auction cleared at 1.05x cover, with the long end c.+45bps higher versus previous stops (actual < forecast). Post-auction, sentiment turned […]

Weekly Market Report: December 1 – 5th, 2025

Fixed Income in Focus: The week opened with sentiment skewed bearish despite net system liquidity firm at c.₦2.19tn. The T-bills market began on a softer note, with the 19-Nov bill pulling back c.15bps ahead of the mid-week auction, which cleared 146bps above previous stop rates on the long end at an overall bid-to-cover of 1.11x. […]

Weekly Market Report MPC EDITION: November 24-28th, 2025

Fixed Income in Focus: The week opened on a mild note with surplus liquidity of about c.₦1.2tn, as attention centered on Monday’s FGN bond auction, which cleared 11.5bps and 15bps higher on the reopened 2030s and 2032s at an overall cover of 1.13x. At Tuesday’s 303rd MPC meeting, the CBN left the MPR unchanged at […]

Weekly Market Report: November17-21st, 2025

Fixed Income in Focus: The week opened quietly ahead of the October inflation print, with system liquidity surplus at c.₦1.3tn. Trading opened with mid-tenor bonds rallying after headline inflation fell to 16.08% (-197bps m/m), though profit-taking later in the week saw yields retrace by c.25bps into the close. In the T-bills market, activity was bullish […]

Weekly Market Report: November 10-14th, 2025

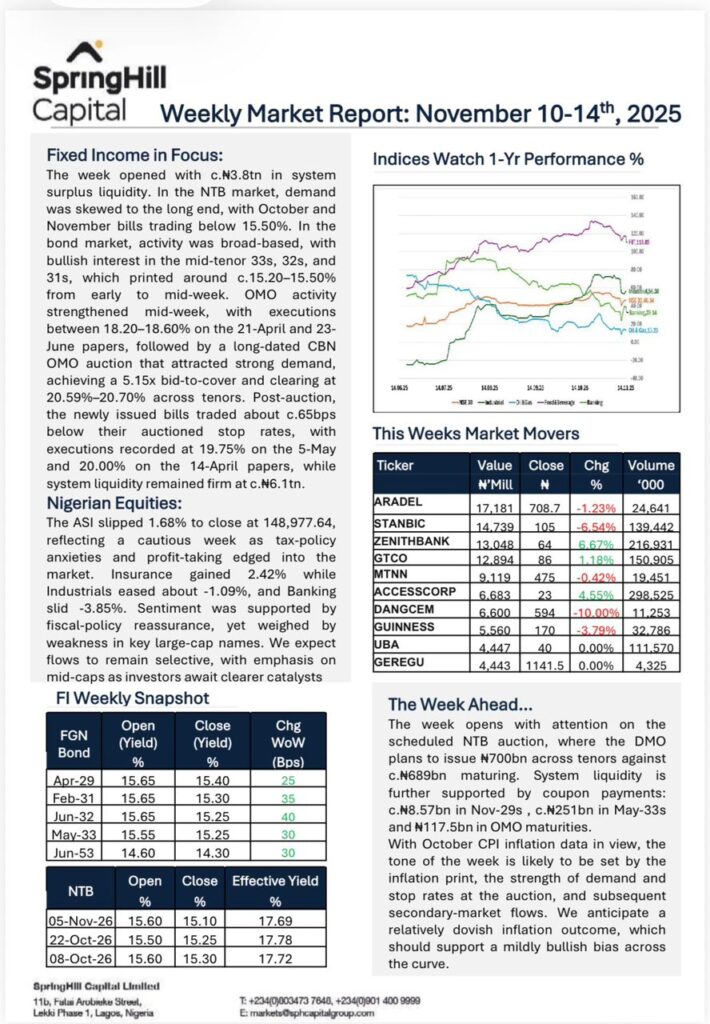

Fixed Income in Focus: The week opened with c.₦3.8tn in system surplus liquidity. In the NTB market, demand was skewed to the long end, with October and November bills trading below 15.50%. In the bond market, activity was broad-based, with bullish interest in the mid-tenor 33s, 32s, and 31s, which printed around c.15.20–15.50% from early […]

Weekly Market Report: November 3-7th, 2025

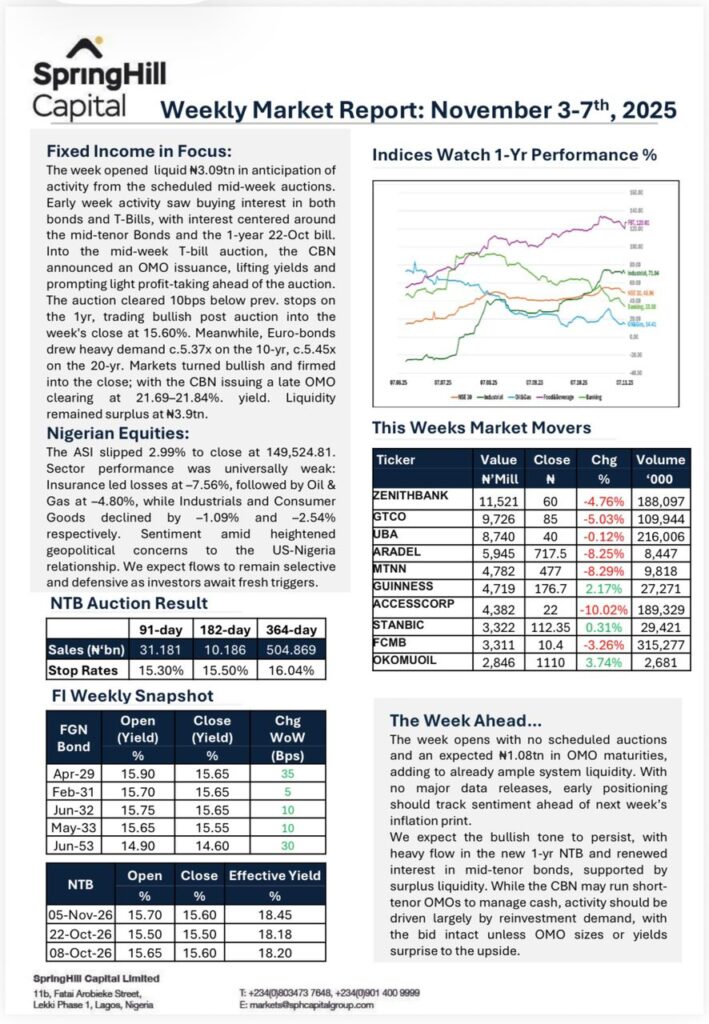

Fixed Income in Focus: The week opened liquid ₦3.09tn in anticipation of activity from the scheduled mid-week auctions. Early week activity saw buying interest in both bonds and T-Bills, with interest centered around the mid-tenor Bonds and the 1-year 22-Oct bill. Into the mid-week T-bill auction, the CBN announced an OMO issuance, lifting yields and […]

Weekly Market Report: October 27 – 31St, 2025

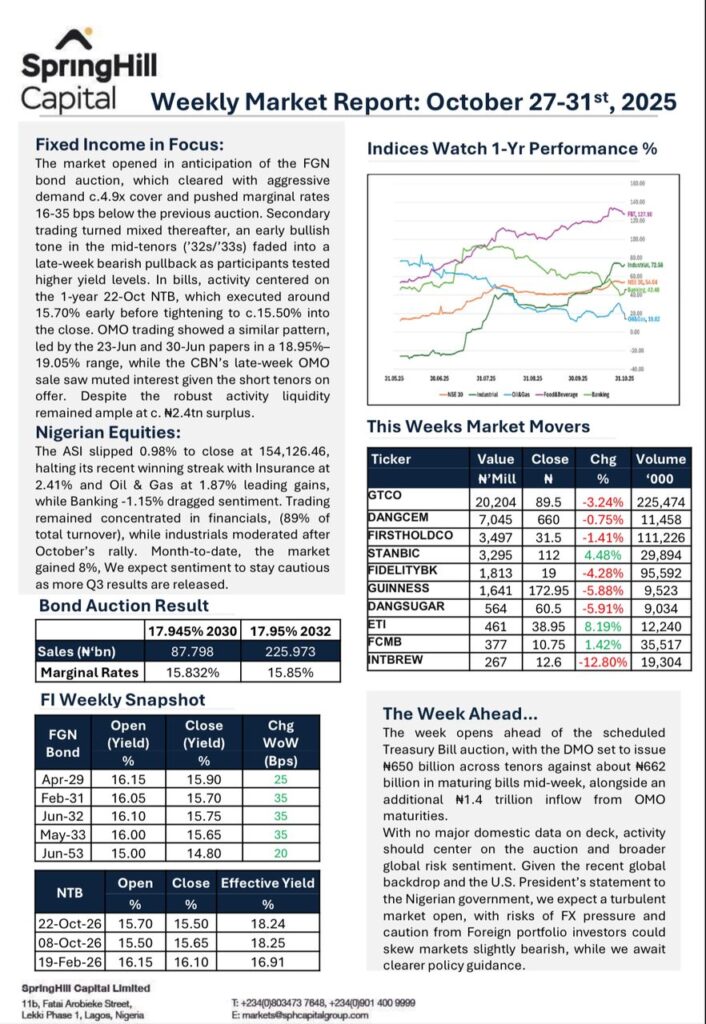

Fixed Income in Focus: The market opened in anticipation of the FGN bond auction, which cleared with aggressive demand c.4.9x cover and pushed marginal rates 16-35 bps below the previous auction. Secondary trading turned mixed thereafter, an early bullish tone in the mid-tenors (’32s/’33s) faded into a late-week bearish pullback as participants tested higher yield […]

Weekly Market Report: October 20-24th, 2025

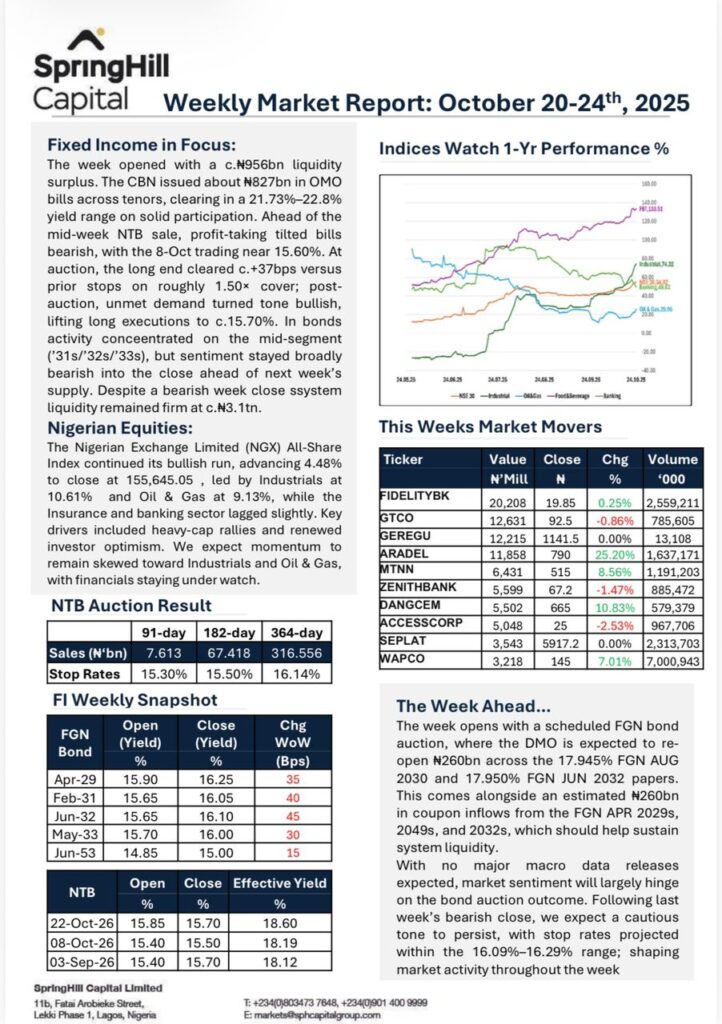

Fixed Income in Focus: The week opened with a c.₦956bn liquidity surplus. The CBN issued about ₦827bn in OMO bills across tenors, clearing in a 21.73%–22.8% yield range on solid participation. Ahead of the mid-week NTB sale, profit-taking tilted bills bearish, with the 8-Oct trading near 15.60%. At auction, the long end cleared c.+37bps versus […]

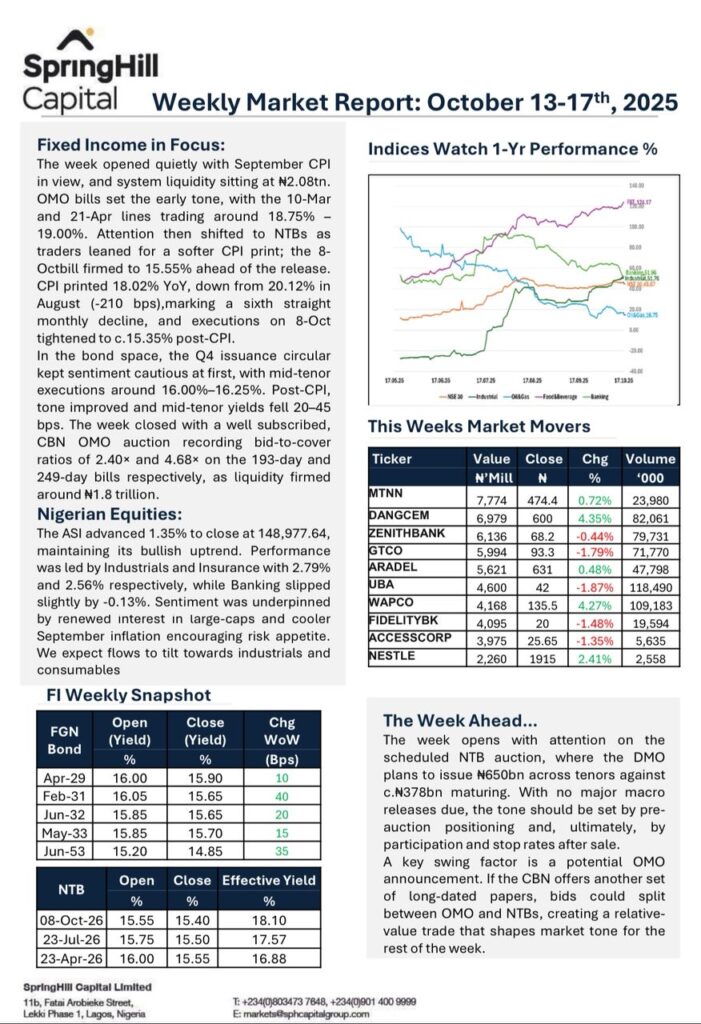

Weekly Market Report: October 13 – 17th, 2025

Fixed Income in Focus: The week opened quietly with September CPI in view, and system liquidity sitting at ₦2.08tn. OMO bills set the early tone, with the 10-Mar and 21-Apr lines trading around 18.75% – 19.00%. Attention then shifted to NTBs as traders leaned for a softer CPI print; the 8-Octbill firmed to 15.55% ahead […]

Weekly Market Report: October 6-10th, 2025

Fixed Income in Focus: The week opened with heavy activity across local fixed income: the CBN issued about ₦3.2tn in OMO bills across tenors, closing in a 21.16%–21.54% yield range, driven by reinvestment demand and supported by ample liquidity. Attention shifted mid-week to the NTB auction, where the DMO brought its largest 364-day supply in […]