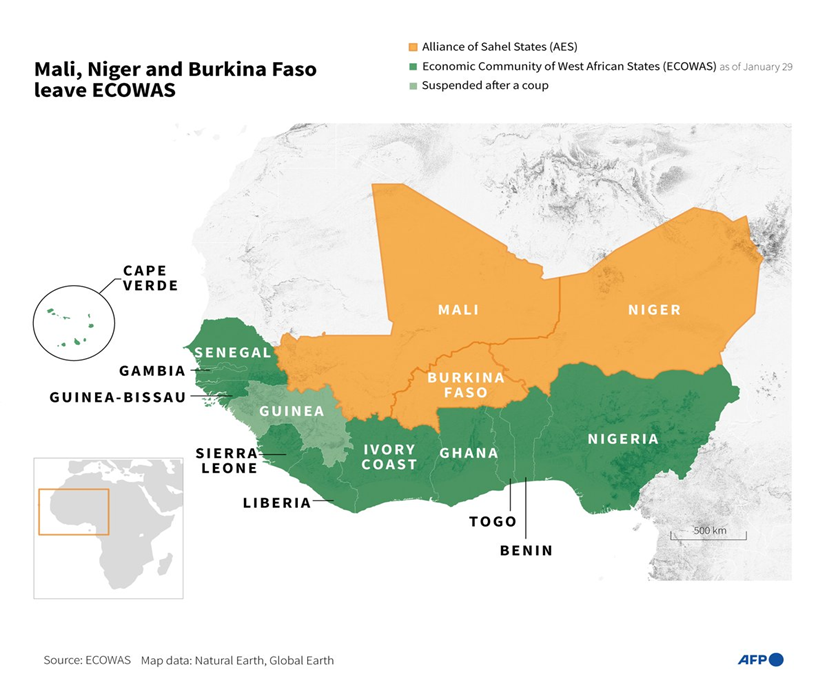

Understand the power shifts redefining West Africa. Our latest report unpacks Burkina Faso’s pivot from France to Russia, rising regional tensions, and what it all means for Nigeria’s leadership and ECOWAS’s future.

Discussion Points

- Burkina Faso deepening military rule while pivoting away from Western institutions.

- Russia has filled the vacuum left by France, offering military support, grain, fertilizer, and energy deals as part of a growing Sahel presence.

- Nigeria faces mounting pressure to lead a fragmented region, balancing ECOWAS unity with rising cross-border insecurity and diplomatic realignment.

From Revolution to Realignment: Burkina Faso’s New Order

Since seizing power in 2022, Captain Ibrahim Traoré has solidified Burkina Faso’s military rule. A 2024 transition plan postponed elections until 2029, and an attempted coup in April 2025 only tightened the junta’s grip (Bloomberg; Peoples Dispatch, 2025).The security outlook remains grim. Over 6,100 conflict-related deaths were recorded in 2024, with more than 2 million people displaced (ACLED, UNHCR, 2024). Despite ramping up local militia recruitment, jihadist groups still control much of the north and east.

Key Events and Timelines:

| Timeline | Events |

|---|---|

| Sept 2022 | Captain Ibrahim Traoré seizes power in a military coup |

| 2023 (full year) | Gold production reaches 57.3 tonnes (official government data) |

| 2024 (early) | SOPAMIB created as state mining company |

| Sept 2024 | Nationalization of Boungou and Wahgnion gold mines |

| Nov 2024 | Gold output declines to 47.7 tonnes YTD (Ecofin Agency) |

| Jan 29, 2025 | Burkina Faso formally exits ECOWAS |

| Mar 17, 2025 | Withdrawal from La Francophonie announced |

| Apr 10, 2025 | Attempted coup foiled; junta blames foreign interference |

Burkina Faso has doubled down on resource nationalism:

- Creating SOPAMIB, a state mining company.

- Nationalized Boungou and Wahgnion gold mines.

- Launched a domestic gold refinery to process output locally (Reuters, 2024).

- Official 2023 gold production came in at just 57 tonnes, far below the projected 100 (Burkina Faso PM Office, 2024).

These shifts reflect a broader ideological pivot. In early 2025, Burkina Faso formally withdrew from ECOWAS and La Francophonie, distancing itself from traditional Western-aligned institutions.

France Out, Russia In: A Changing Sahel

France Out, Russia In: A Changing Sahel France withdrew its troops from Burkina Faso in February 2023, ending decades of military cooperation (Al Jazeera, 2023). Russia filled the vacuum, deploying 100 Africa Corps troops in January 2024 to support and train the regime (AP, 2024).

Alongside security aid, Russia sent:

- 25,000 tonnes of wheat

- 23,000 tonnes of fertilizer (TASS; Uralchem, 2024)

- A nuclear partnership with Rosatom was also signed, with planning underway despite no construction yet (World Nuclear News, 2024).

Now part of the Alliance of Sahel States, Burkina Faso is realigning toward sovereignty-first politics and stronger ties with non-Western powers.

Gold Mine Ownership in Burkina Faso (2025):

| Mine | Current Owner | Ownership type |

|---|---|---|

| Boungou | SOPAMIB (Burkina Faso) | Nationalized |

| Wahgnion | SOPAMIB (Burkina Faso) | Nationalized |

| Essakane | IAMGOLD (Canada) | Foreign owned |

| Sanbrado | West African Resources (AU) | Foreign owned |

| Houndé | Endeavour Mining (UK) | Foreign owned |

| Kourweogo | Nordgold (Russia) | Foreign owned |

Closing Note: Nigeria’s Balancing Act

In 2025, Nigeria is navigating a fragile regional landscape shaped by shifting alliances and rising security threats. As ECOWAS chair, President Bola Tinubu has led efforts to manage the withdrawal of Burkina Faso, Mali, and Niger from the bloc. Despite ECOWAS offering a six-month grace period, the Alliance of Sahel States (AES) formalized its exit on January 29, 2025.

The departure of French forces from the Sahel has created a widening security vacuum. Jihadist activity has intensified near Nigeria’s northern borders, prompting urgent concern. Meanwhile, the AES bloc has turned to Russia for military and logistical backing. In May 2025, Russian Africa Corps special forces were deployed to Burkina Faso, a clear signal of growing non-Western influence in the region. Economically, Nigeria faces another challenge: maintaining trade and diplomatic cooperation amid growing fragmentation.

The AES’s alignment with Morocco to access Atlantic ports may redirect key trade flows away from ECOWAS channels (Reuters, 2025), straining existing integration efforts.

Kindly find the Report Below

Thanks for reading.