Fixed Income in Focus:

The week opened with sentiment skewed bearish despite net system liquidity firm at c.₦2.19tn. The T-bills market began on a softer note, with the 19-Nov bill pulling back c.15bps ahead of the mid-week auction, which cleared 146bps above previous stop rates on the long end at an overall bid-to-cover of 1.11x. Post-auction, the new bill traded around 17.25% before a bearish reversal driven by profit-taking and the surprise release of a revised Q4 auction calendar. The bond market mirrored this tone, with selling in the mid-tenors (31s, 32s and 33s) pushing yields into the 16.70–16.90% band. The OMO space held firm, with activity concentrated in the 5-May and 19-May papers at 19.75–19.85%, while liquidity remained robust, closing the week at c.₦3.2tn.

Nigerian Equities:

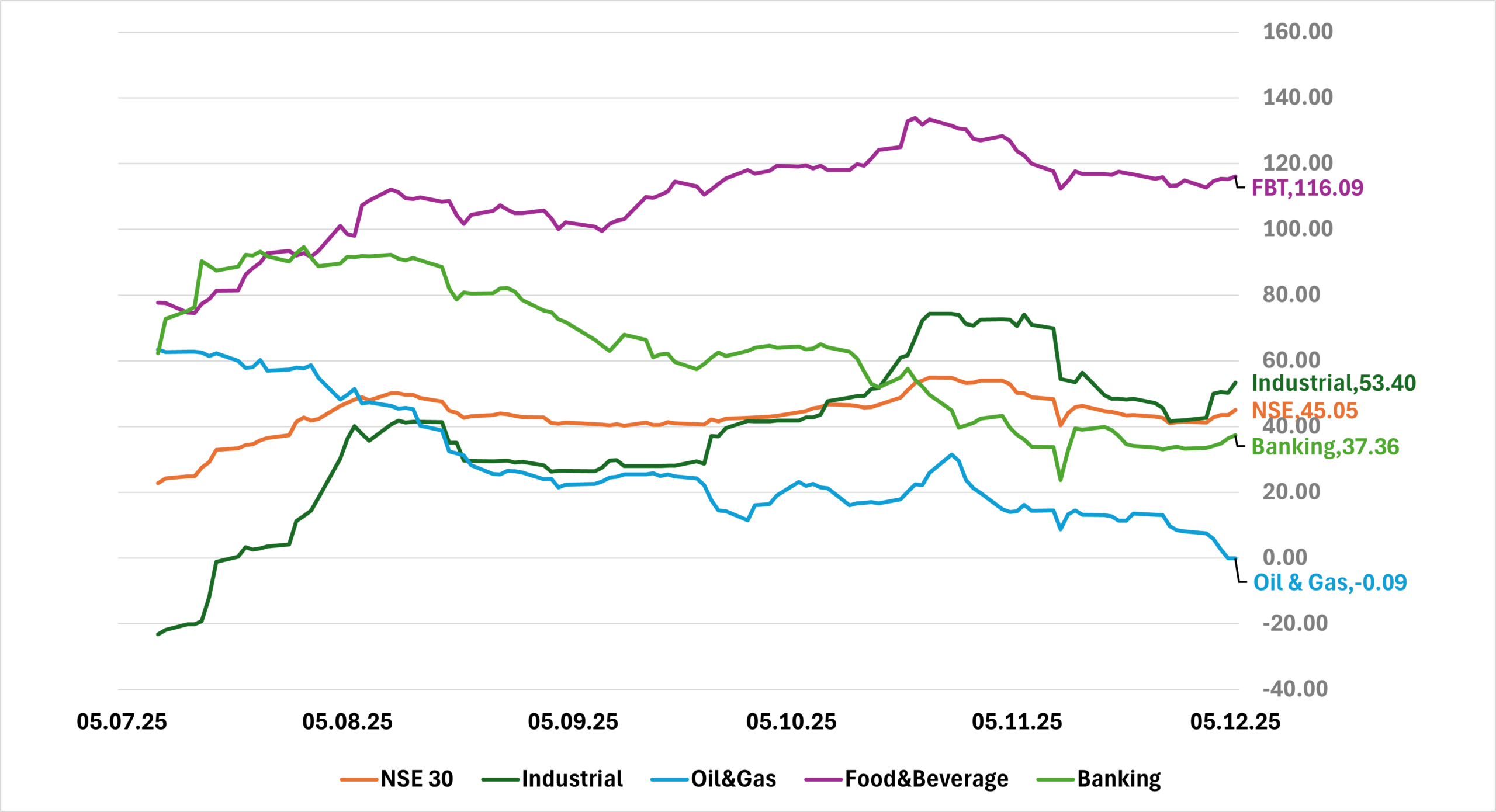

The ASI advanced 2.45% this week,Industrials led performance with a strong 7.38%, while Banking and Insurance added 3.20% and 1.48% respectively; Oil & Gas softened slightly at -0.57%. Renewed demand in the industrial majors,Dangote Cement, BUA Cement and WAPCO, lifted market sentiment. Flows stayed active in large caps, with rebalancing momentum likely to hold in Industrials and Financials.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 42.804 | 30.356 | 636.460 |

| Stop Rates | 15.30% | 15.50% | 17.50% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 15.80 | 16.90 | (110) |

| Feb-31 | 15.85 | 16.85 | (100) |

| Jun-32 | 15.90 | 16.85 | (95) |

| May-33 | 15.60 | 16.80 | (120) |

| Jun-53 | 14.40 | 15.00 | (60) |

| NTB | Open | Close | Effective Yield |

| % | % | % | |

| 03-Dec-26 | 17.25 | 17.50 | 21.16 |

| 19-Nov-26 | 16.05 | 17.00 | 19.97 |

| 08-Jan-26 | 15.75 | 16.00 | 16.23 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week is set against a scheduled Treasury bill auction, the second in a series of back-to-back sales, where the DMO is set to issue ₦750bn – the largest supply this quarter – against an expected ₦1.582tn inflow from T-bill and OMO maturities.

Given recent secondary-market activity, the last auction’s clearing levels and the heavy supply this month (c.₦2.15tn scheduled across three auctions), we anticipate a relatively bearish auction with c.25bps upward pressure on previous stop rates. Overall activity will largely be dictated by the outcome of this week’s auction.