Fixed Income in Focus:

The week opened on a mild note with surplus liquidity of about c.₦1.2tn, as attention centered on Monday’s FGN bond auction, which cleared 11.5bps and 15bps higher on the reopened 2030s and 2032s at an overall cover of 1.13x. At Tuesday’s 303rd MPC meeting, the CBN left the MPR unchanged at 27% but adjusted the corridor, an overall softer read than the market had expected. Against this backdrop of the MPC outcome vs market expectations, the bond market turned bearish, with mid-tenor papers (31s, 32s and 33s) executed in the 15.80–15.90% band. The Treasury bills segment saw the 364-day 19-Nov paper close around 16.05% and OMO bills trading bullish post MPC, with the 19-May in the 19.55–19.65% band into the close as system liquidity remained firm at c.₦1.96tn.

Nigerian Equities:

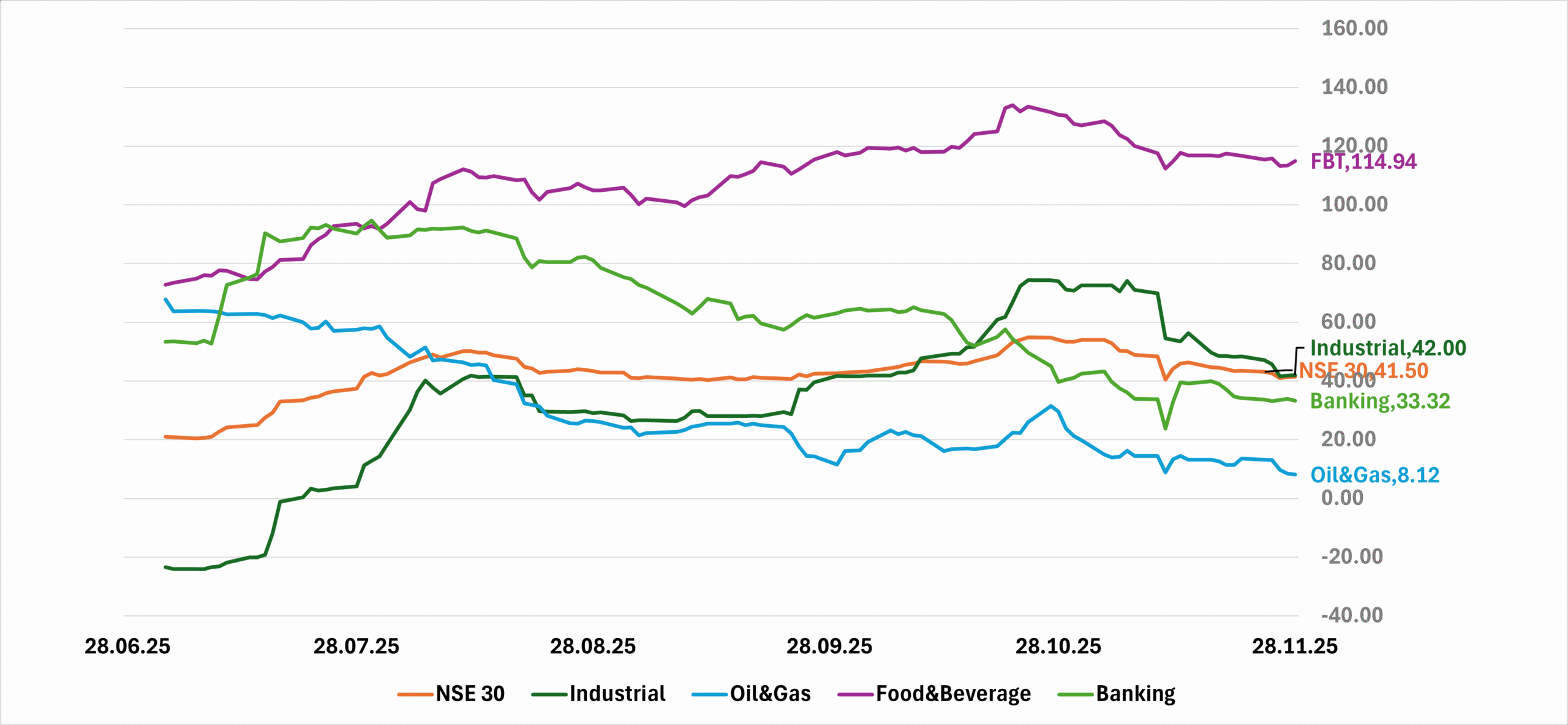

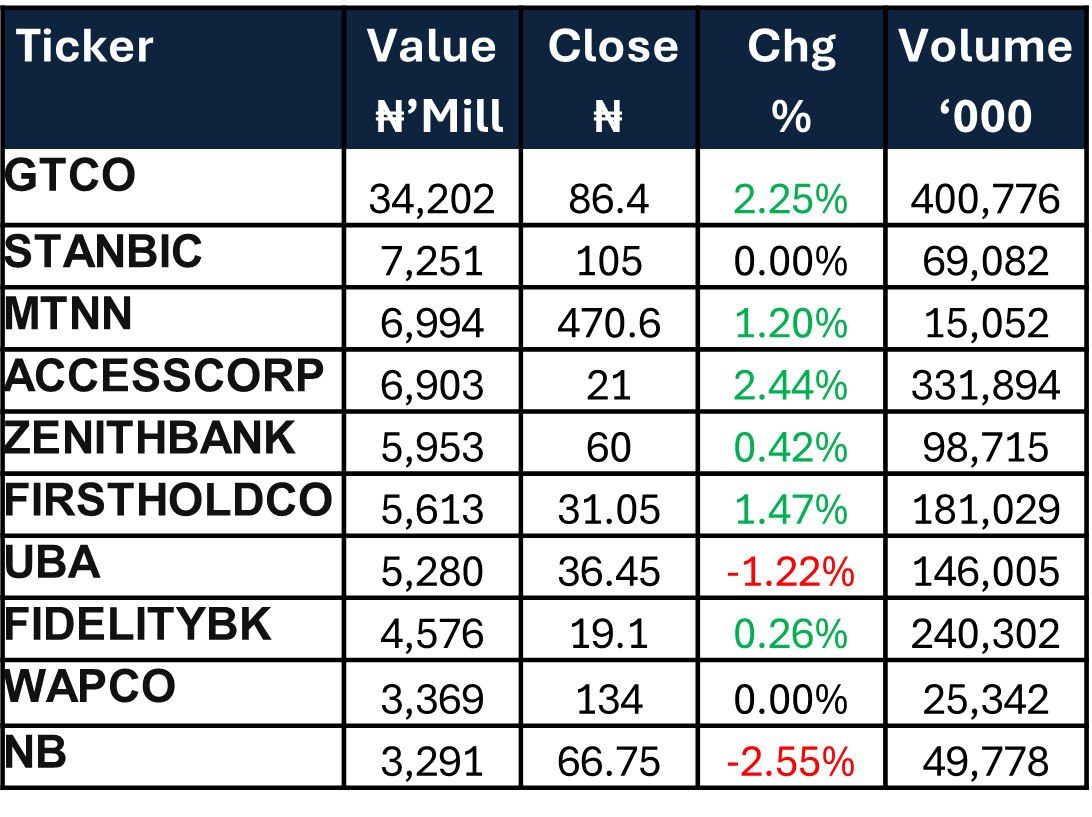

The ASI edged down – 0.14% to 143,520.53, reflecting a quiet, cautious market. Sector performance was mixed as Industrials (-1.92%) and Consumer Goods (-0.70%) weakened, while Banking (+0.67%) showed mild recovery. MPC’s decision was to hold the MPR at 27% and maintain a defensive tone. We expect cautious, selective flows to persist into month-end.

Bond Auction Result

| 17.945% 2030 | 17.95% 2032 | |

| Sales (₦‘bn) | 134.8 | 448.72 |

| Marginal Rates | 15.90% | 16.00% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 15.60 | 15.80 | (20) |

| Feb-31 | 15.60 | 15.85 | (25) |

| Jun-32 | 15.60 | 15.90 | (30) |

| May-33 | 15.55 | 15.60 | (5) |

| Jun-53 | 14.40 | 14.40 | – |

| NTB | Open | Close | Effective Yield |

| % | % | % | |

| 19-Nov-26 | 15.80 | 16.05 | 19.01 |

| 22-Oct-26 | 15.50 | 15.55 | 18.06 |

| 19-Feb-26 | 15.15 | 15.20 | 15.73 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

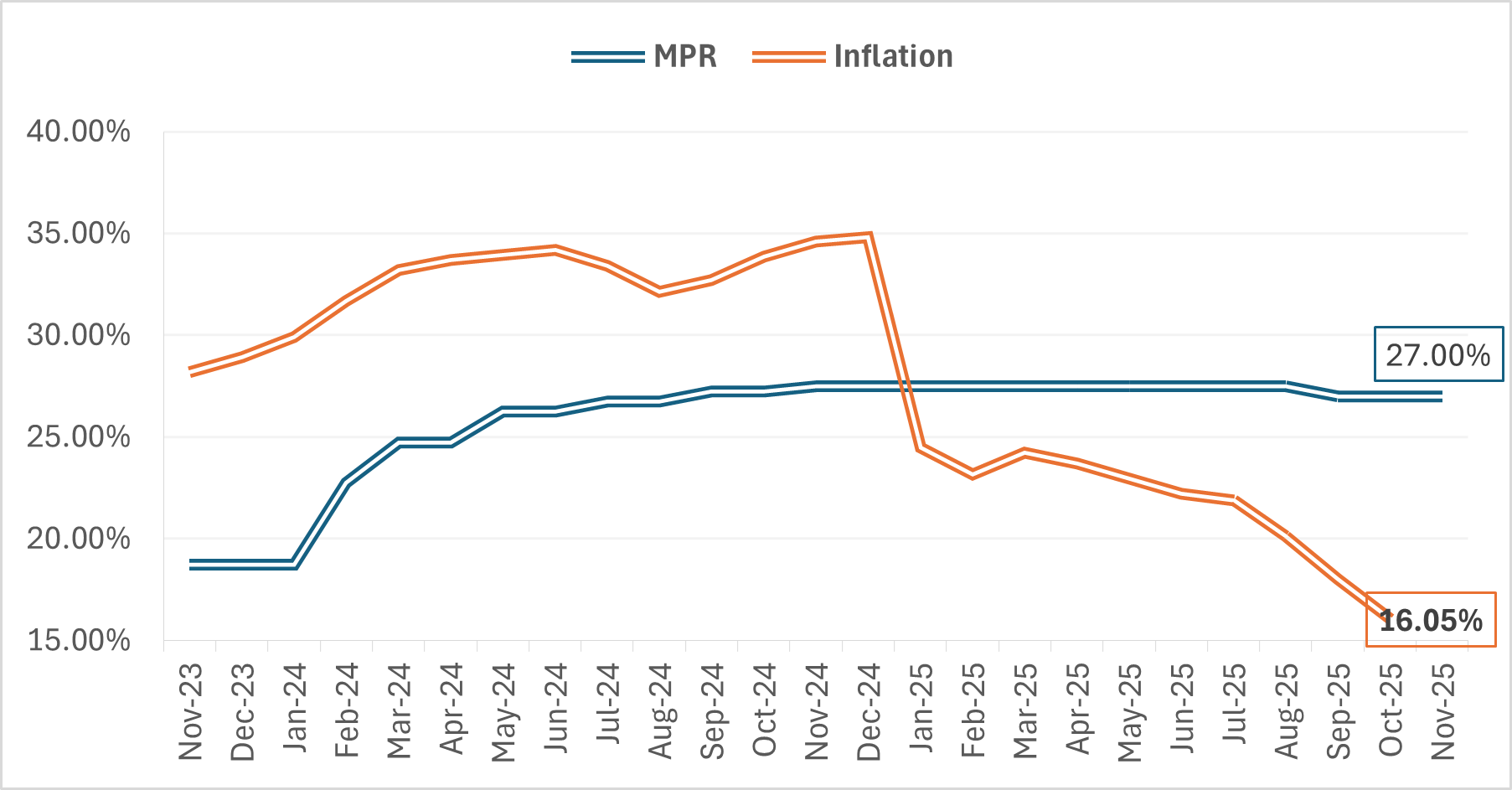

Monetary Policy Rate Expectation

MPC Policy View:

As at the 303rd Monetary Policy Committee (MPC) Meeting held on November 24th–25th 2025, the Committee decided to retain the Monetary Policy Rate (MPR) at 27.00%. Other parameters were maintained as follows: the Cash Reserve Ratio (CRR) for commercial banks was kept at 45%, the CRR for merchant banks at 16%, the 75% CRR on non-TSA public sector deposits remained in place, and the Liquidity Ratio was held at 30%. However, the Asymmetric Corridor around the MPR was re-calibrated from +250/-250 basis points to +50/-450 basis points, in a bid to influence short-term interest rates and manage banking-system liquidity more flexibly. With 30-day, 60-day and 90-day moving average of system liquidity at 3.9tr, 3.4tr and 3.2tr respectively, the corridor adjustment will compress OMO yields going forward and possibly force banks to adjust deposit rates being offered to fund managers to maintain their Net Interest Margin.

Nigeria’s headline inflation eased to 16.05% in October 2025, from 18.02% in September and 20.12% in August, extending a seven-month disinflation streak, with both food and core inflation trending lower even as Month-on-Month quickened to 0.93% from 0.72%. Against this backdrop, markets went into the November 303rd MPC meeting positioned for a rate cut, but the outcome fell short of those expectations, prompting a reassessment of the pace of future easing even as the softer inflation path

The Week Ahead…

The week opens ahead of a scheduled FGN Treasury bills auction, where the DMO is set to issue ₦700bn across tenors against c.₦803bn in maturing paper. With no major macroeconomic data in view, market activity is likely to hinge on the auction outcome. Given the sizeable supply on offer, recent secondary-market dynamics and current levels on the previous 364-day issue, we anticipate a bearish auction, with stop rates likely to climb by at least c.10bps in the primary market.