Fixed Income in Focus:

The week opened on a bearish tone, with the bond market seeing decent activity as investors cut exposure, pushing yields above the 17% mark. An early OMO auction 7-April cleared at 28.18% yield ~ 82bps above the previous sale before trading down to 27.24% and closing at 27.59%. Mid-week, the NTB auction saw the new 365-day bill clear 62bps higher than previous issue, the first increase in five auctions signaling a possible shift from the recent bullish issuance trend. Unmet demand spilled into the secondary market, trading the new bill to close at 16.40%. Overall, the market remained net positive closing at ₦750bn.

Nigerian Equities:

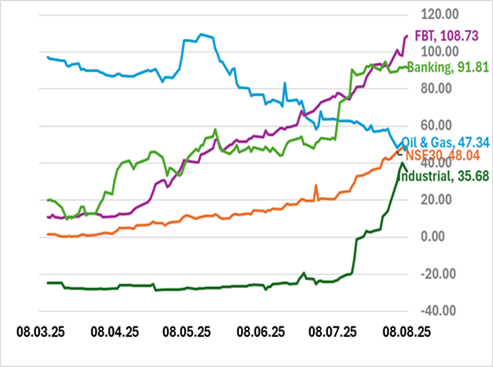

The All-Share Index ends the week at 145,754.91 gaining 3.18% this week. Trading activity defined by signing of the Nigeria Insurance Industry Reform Act (NIIRA 2025) which caused the insurance sector to reprice 41% upward. Industrial continued bull run posting a 8.73% gain for the week. Banking sector lost 0.75% in value amid profit-taking. We expect moderation and further repositioning in financial sectors this week.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 15.334 | 18.320 | 139.594 |

| Stop Rates | 15.00% | 15.50% | 16.50% |

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 16.90 | 17.00 | (10) |

| Feb-31 | 16.65 | 16.90 | (25) |

| May-33 | 16.65 | 16.85 | (20) |

| Jan-35 | 16.40 | – | – |

| Jun-53 | 15.80 | 15.90 | (10) |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 06-Aug-26 | 16.15 | 16.40 | 19.58 |

| 23-Jul-26 | 15.70 | 16.45 | 19.50 |

| 05-Mar-26 | 17.10 | 17.05 | 18.88 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

The week opens with no scheduled auctions and no significant inflows expected. Activity will likely be driven by secondary market flows and positioning ahead of key macro data releases.

The main focus will be on the July CPI inflation report due at the end of the week, which could influence monetary policy expectations and set the tone for fixed income trading. Investors may adopt a cautious stance early on, with sentiment shifting as inflation data provides clearer signals on yield direction.