Our latest report unpacks the fallout from the CBN’s June 2025 directive, spotlighting the balance sheet reset across Nigerian banks, the winners emerging with clean books, and the cautious recovery path ahead.

Key Points

- June 2025 Reckoning: The CBN’s dividend freeze exposed balance sheet fragilities, wiping ₦121bn off banking stocks in a day.

- Modelling the Uncertainty: Investors seeking exposure to Nigerian banking stocks can employ a diversified approach that considers the additional loan provisions they will incur this year.

From Relief to Reliance: How We Got Here

When COVID-19 hit in 2020, the Central Bank of Nigeria (CBN) stepped in with an emergency toolkit to preserve credit flow and stabilize the banking system.The response was swift and aggressive:

The response was swift and aggressive:

•Loan repayment moratoriums were extended,

•Interest rates on intervention funds were slashed,

•Banks were allowed to restructure distressed loans without taking the full hit to their books,

•Breaches of key prudential thresholds like the Single Obligor Limit (SOL) were quietly tolerated.

It worked for a while. Forbearance gave banks the space to keep lending as the economy found its footing. Stage 2 loans those showing early signs of trouble grew over 40% annually between 2020 and 2024. Many banks used the window to expand risk assets and maintain dividends, creating an image of resilience. But underneath, fragility was building. Repeated devaluations, inflation, and FX stress exposed the limits of the relief. What began as a temporary fix had hardened into quiet dependency. By early 2025, the sector’s apparent health, propped up by under-provisioned loans and unsustainable payouts had become too risky to ignore.

June 2025: The CBN Ends the Free Ride

On June 13, 2025, the Central Bank of Nigeria issued a sweeping directive: any bank still relying on regulatory forbearance or breaching key prudential limits must immediately suspend dividends, executive bonuses, and foreign investments until full compliance is independently verified. This marked the end of a four-year grace period that had allowed banks to defer full recognition of bad loans and continue rewarding shareholders despite underlying risk.

Key Impacts:

• Dividend Uncertainty: The CBN’s June 2025 directive has led Access, Zenith, UBA, Fidelity, and FCMB to possibly suspend interim dividends. In contrast, GTCO and Stanbic IBTC, with zero exposure to regulatory forbearance, are still paying both interim and final dividends.

• Asset quality pressure: Analysts from Renaissance Capital report that Zenith (23%), Fidelity (10%), FCMB (8%), Access (4%), and UBA (~5–6%) have material forbearance-linked loan exposure, while GTCO and Stanbic IBTC report zero. As forbearance ends, these exposures must be reclassified and fully provisioned, significantly tightening capital buffers.

• Market response: The NGX Banking Index fell 3.98% on June 16, wiping off approximately ₦121 billion in market value the third-largest single-day drop in 2025. In the days that followed, investors rotated into safer names, with GTCO surging ~16% and Stanbic IBTC ~9.6%

Who’s Ready, Who’s Not: Navigating the Shakeout

The CBN’s June 2025 directive has turned the spotlight on the fundamentals. It’s no longer enough to look profitable banks now have to prove it. Dividend restrictions, provisioning mandates, and capital adequacy requirements have made the strong banks stand out, the reforming banks scramble, and the opaque banks harder to trust. Below is a strategic breakdown of where Nigeria’s top banks stand, what they’re doing, and how investors should be thinking about them:

Banking Sector Outlook: Post-CBN Directive

| Category | Banks | Status | Outlook | Positioning |

|---|---|---|---|---|

| Safe Havens | GTCO, Stanbic IBTC | No forbearance. Dividends intact. | Strong, stable. | Hold or buy. |

| Rebound Picks | Zenith, Access, UBA, Fidelity, FCMB | Affected but actively cleaning up. | Recovery likely by 2026. | Accumulate selectively. |

| Watchlist | ETI, FirstHoldCo | Low disclosure, unclear timelines | High risk, low visibility. | Avoid for now. |

Who’s Ready, Who’s Not: Navigating the Shakeout

1) Banking Sector Outlook: Post-CBN Directive

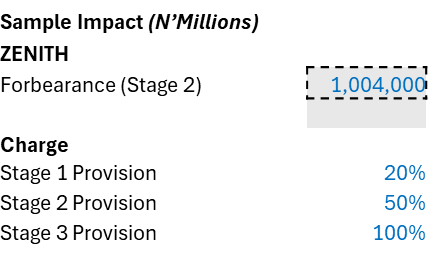

Among the Tier 1 banks, it was revealed that Zenith had the highest gross loan amounts under forbearance estimated at N1.04tn with Access, UBA, and GTCO with N471bn, N437bn and N0 respectively. FirstHoldCo has not yet disclosed their own gross amounts, but it is safe to say that it may range above N400bn. The impact of bringing these exposures under regulatory limit is not straightforward and would require sessions with the respective bank’s CFOs. However, with a little knowledge of IFRS rules, we may be able to estimate worst case and base case scenarios for the subsequent provisioning that will impact the H1 2025 results and the full year 2025 results. Using Zenith, we show how the provisioning may take place:

• Loans granted forbearance are classified as stage 2 ECL loans.

• Stage 2 under IFRS 9 represents financial assets where there has been a significant increase in credit risk since initial recognition, but the asset is not yet considered credit-impaired (i.e., not in default). 50% of the gross loan amount is provisioned and charged to the P&L.

• 20% of stage 1 ECL loans (No significant credit impairment) is charged. 100% of stage 3 ECL loans (Default) is charged.

• Since the loans are already under Stage 2, we need to work out scenarios where they will be reclassified and the subsequent additional charges incurred.

• In the worst-case scenario, a 70% transfer of N1.04tn Stage 2 to Stage 3 will incur an additional charge of N351bn.

• A 30% transfer from Stage 2 to Stage 1 would incur a writeback of N90bn, bringing the net additional charge on the P&L to be N261bn.

• For the best-case scenario, we expect a net writeback of N60bn, a gain.

• In summary, the passthrough of the forbearance charge will not surpass 50% of the gross amount even in an unlikely scenario of 100% transfer to Stage 3.

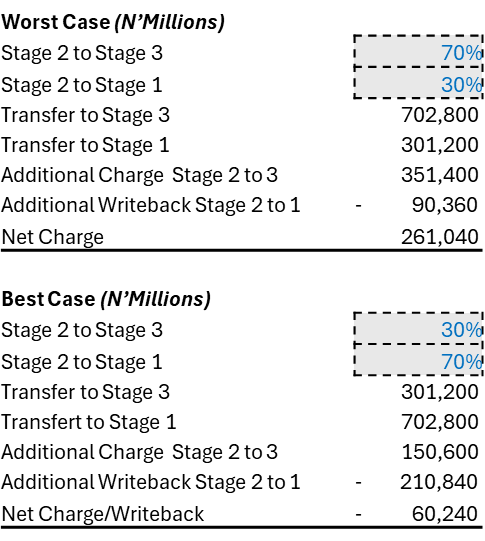

2) Estimated Impact Across Banks

Using the same logic for the net charge/writebacks across banks that still bear significant forbearance exposures, we have compiled the impact on the FY2025 impairment charge as follows:

3) Impact on Net Income

• In estimating the impact on net income, we believe it prudent to limit the number of assumptions and simplify the passthrough.

• Therefore, the underlying logic is that banks will buffer any additional impairment losses with trading activities, fees and commissions.

• This is intuitive given the position of the loan impairment charge higher up the income statement, after the bank’s core activities of quality loan generation.

• We highlight our thesis with two examples Zenithbank and Access.

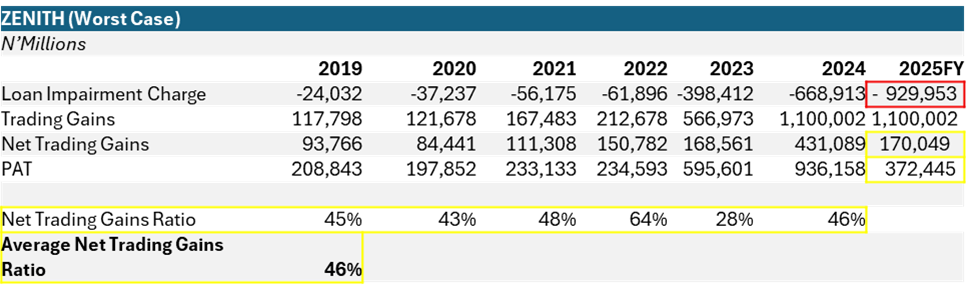

• The past 5 years have shown that Zenith’s trading activities can be largely relied upon to buffer the impairment charge with a Net Trading Gains Ratio ((Trading Gains – Loan Impairment Charge)/PAT) of 46%.

• We estimate the loan impairment charge under the worst case to increase to –N929bn, net trading gains to be N170bn and a final estimated PAT of N372 billion for FY 2025.

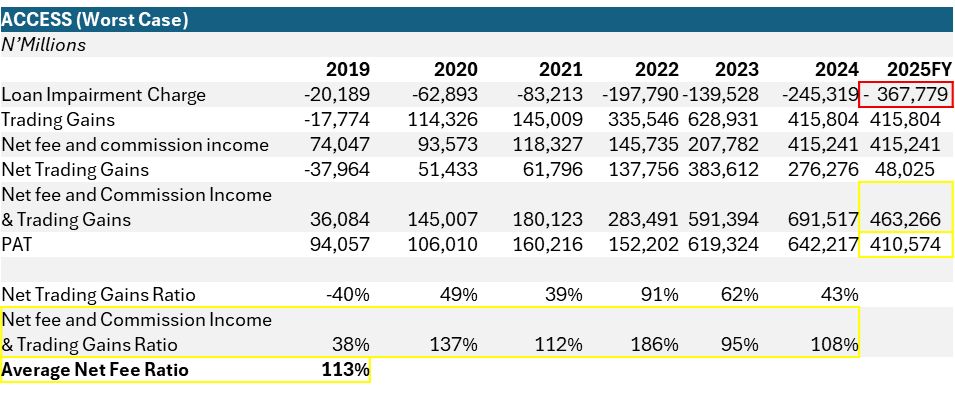

• Access bank’s business model differs from Zenith is that there is more stability in the buffer from trading gains and fee and commission income.

• Hence our Net Fee, Commission and Trading Gains ratio is as follows:

(Net Fee and Commission Income + Trading Gains – Loan Impairment Charge)/PAT

= Net Fee and Commission Income & Trading Gains Ratio

• With Loan impairment charge increasing to –N367Bn under the worst case, we estimate a PAT of N410Bn for FY2025.

4) Impact on Valuation

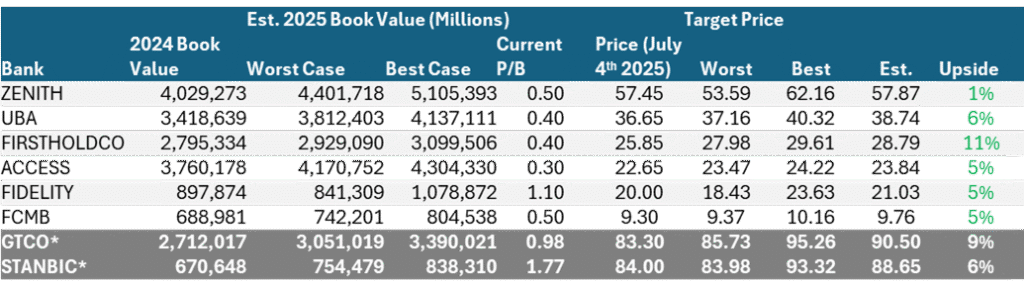

• By deriving various estimates for the FY2025 PAT across the banks in coverage, we can then infer the given book value for the year as follows:

• We highlight GTCO and Stanbic IBTC as the exceptions to the procedure given their success of prudent provisioning of forbearance loans and having no loans under forbearance.

• Likewise, we estimated a 12.5% and 25% growth in book value under the worst and base case respectively for the two banks.

• At current levels, we can estimate a base target price, midway between the worst and best to realize a possible 5% upside across board at current Price/Book Ratios.

• As expected, any increase in P/B ratio levels would increase our target prices.

5) Optimizing Exposure

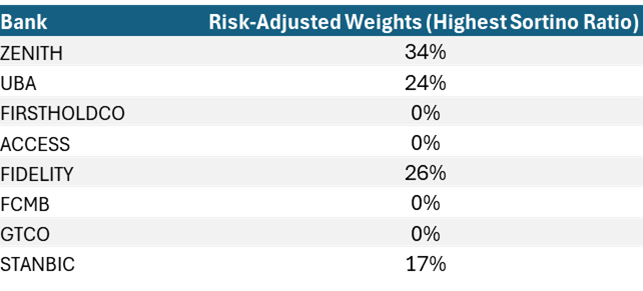

• Using statistical procedures, we can estimate an optimal portfolio weight that incorporates the historical downside risk of the asset not meeting the upside target in the valuation table above.

• The relevant risk measure moves beyond Sharpe Ratio into Sortino Ratio which measures the excess return above the target return given the historical volatility of the asset not meeting that target.

• Mean Variance Optimization (MVO) Methods use historical return data as inputs.

• Given the 0% weight to GTCO, the MVO is a good starting point but must be supplemented with current market views and information that essentially goes beyond historical price data.

• The MVO also does not consider any dividend expectations.

Aligning Expectations

In conclusion, while the CBN’s June 2025 directive has unveiled balance‐sheet vulnerabilities and driven a temporary pullback in share prices, our analysis shows that even in the worst‐case provisioning scenario most Nigerian banks will end 2025 with higher book values than they began the year. GTCO and Stanbic IBTC emerge as clear leaders—with clean books and intact dividends—while the other major banks are actively rebuilding buffers, positioning themselves for a recovery by 2026. At current price‐to‐book multiples, this translates into moderate upside potential across the sector, suggesting that investors who selectively accumulate on weakness stand to benefit from gradual valuation rerating over the coming months. In short, what began as a shock to capital adequacy is shaping up as a disciplined reset that should support healthier balance sheets and steadier returns going forward.

Kindly find the Report Below

Thanks for reading.