Fixed Income in Focus:

System liquidity opened at ₦293bn following CRR debit. The NTB market started quietly, with offers seen across the curve and limited buying interest, though some trades were recorded on the 22 Jan and 5 Mar bills. On the OMO side, demand was concentrated at the long end, with the 31 Mar OMO trading notably at 22.20%. In the bond space, the 31s and 33s led activity. As coupon inflows filtered in later in the week, we saw a modest pickup in demand. Still, the secondary market closed on a subdued note, with selective interest across curves. Liquidity improved, closing the week at ₦423bn.

Nigerian Equities:

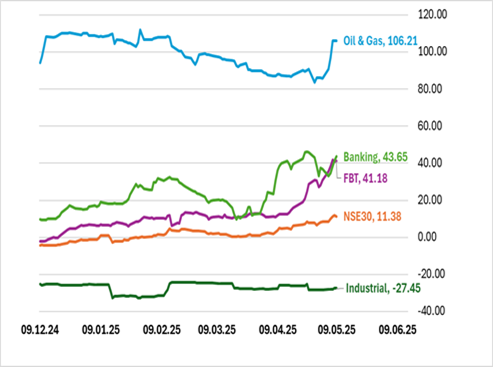

The All-Share Index appreciated an impressive 2.54% this week. Heavy demand for Food & Beverage, Oil & Gas, and Banking stocks prevailed as implied by the 5.41%, 3.98%, and 3.09% gains in their respective indices. The bullish sentiments may reflect higher earnings expectations in wake of positive outcomes from US trade negotiations. Investor interest may continue to build as key macroeconomic data is released domestically.

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.40 | 19.50 | (10) |

| Feb-31 | 19.95 | 19.80 | 15 |

| May-33 | 20.00 | 19.90 | (10) |

| Jan-35 | 19.55 | 19.55 | 0 |

| Jun-53 | 17.00 | 17.00 | 0 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 07-May-26 | 19.55 | 19.40 | 23.61 |

| 23-Apr-26 | 19.30 | 19.20 | 23.40 |

| 09-Apr-26 | 19.20 | 19.15 | 23.12 |

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

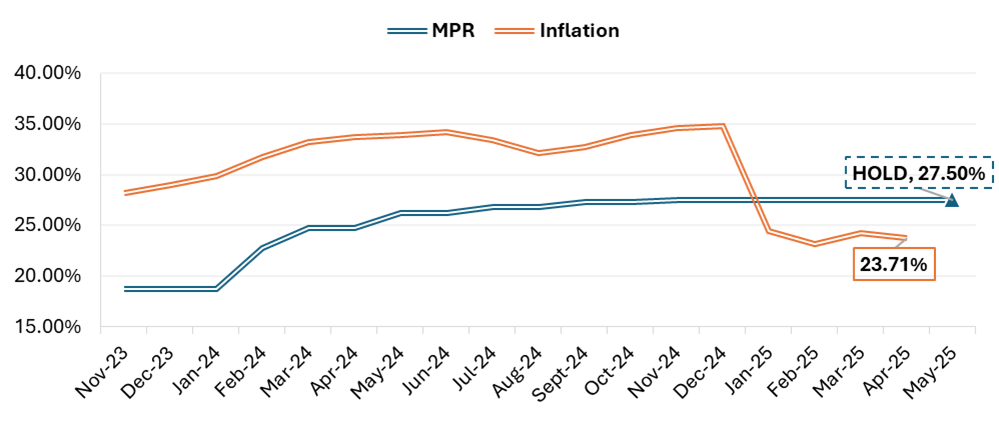

Monetary Policy Rate Expectation:

MPC Policy View:

The key decision of the 299th Monetary Policy Committee (MPC) Meeting held on February 20th, 2025, was to keep key benchmark rates unchanged with MPR remaining at 27.50%. Since headline inflation’s lowest reading in two years, recorded at 23.18% in February, inflation has stayed elevated at 23.71%. This is despite food inflation in April decreasing to 21.26% y-o-y and partly due to core inflation’s stickiness at 23.39%, 80 bps above January’s core inflation low of 22.59%. We await subsequent inflation data to define the trend for 2025.

We expect MPC to hold the benchmark rates at current levels given the unconvincing data that inflation has begun to moderate at a favorable pace. This is supported by CBN Governor Cardoso’s recent comments concerning his expectation of benchmark rates dropping in anticipation of slowing inflation over the next few months.

The Week Ahead…

Next week kicks off with ₦1.76 trillion in expected inflows from bond coupons (14.55% and 19.30% 2029s), OMO, and NTB maturities.

Market attention will turn to Monday’s MPC meeting, where guidance on inflation and liquidity will shape sentiment ahead of Wednesday’s NTB auction. While some offloading may occur ahead of fresh supply, strong inflows are expected to keep demand firm, especially at the short end.