Fixed Income in Focus:

Liquidity opened at ₦290 billion but declined by ₦393 billion, closing in a ₦103 billion deficit, mainly due to FX settlements late in the week. The secondary market for NTBs and FGN bonds was active, with a recovery seen as yields eased from the previous week. The 2031 and 2033 bonds led trading, showing renewed interest in medium- to long-term tenors. OMO bills remained attractive on the short end, with the 3 Feb bill extending to 22.70%. March inflation rose to 24.23% from 23.18%, driven by rising food and beverage prices. This supports expectations that the CBN will maintain its tight monetary stance to tackle inflation and stabilize the naira.

Nigerian Equities:

ASI fell 0.32% as sell-offs and dividend collections continued. Accesscorp and Firstholdco revealed a N2.05 and N0.60 per share respectively. Q1 results have started rolling out with NB delivering a surprise N44 billion PAT. We expect subsequent Q1 result releases to drive trading activity over the coming weeks.

FI Weekly Snapshot

| FGN Bond | Open (Yield) | Close (Yield) | Chg WoW |

| % | % | (Bps) | |

| Apr-29 | 19.50 | 19.50 | 0 |

| Feb-31 | 20.20 | 19.85 | 35 |

| May-33 | 20.15 | 20.00 | 15 |

| Jan-35 | 19.30 | 19.45 | (15) |

| Jun-53 | 17.00 | 16.87 | 13 |

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 9-Apr-26 | 19.25 | 19.10 | 23.46 |

| 26-Mar-26 | 19.15 | 19.00 | 23.10 |

| 19-Mar-26 | 19.10 | 19.00 | 23.00 |

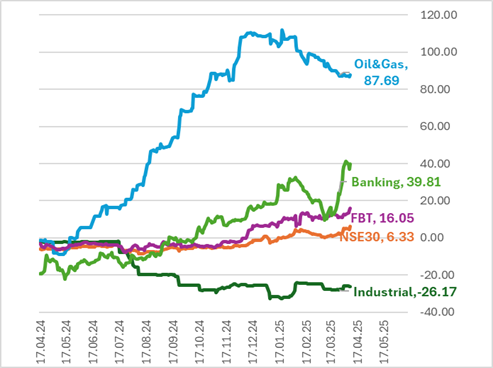

Indices Watch 1-Yr Performance %

This Weeks Market Movers NGX

The Week Ahead…

We expect market sentiment remains cautious ahead of the upcoming NTB auction given tight system liquidity and higher inflation expectations. The CBN’s planned ₦400 billion issuance slightly above maturing bills could drive stop rates higher, particularly on the 364-day tenor.

In the secondary market, activity is likely to stay defensive, with a focus on high-yield, short-term assets as inflationary and funding pressures persist.