Get ahead of market shifts with our Q2 2025 Market Outlook. Analyze US-China trade war effects, asset volatility, and top investment strategies for navigating uncertainty.

Discussion Points

Key points to consider in our Q2 2025 Market Outlook:

• U.S has exempted China from the 90-day tariff pause, placing a 145% tariff on Chinese imports.

• China has retaliated with 125% tariffs on all U.S. imports.

• Extreme volatility of asset prices over the past two weeks.

• What it means to be risk-on versus risk-off

Update on Trade War 2.0

The Trump administration has announced a reversal of previously executed tariffs on all trade partners who did not retaliate for ninety days.

However, this excludes China, as the US carries on with their 145% charge on all China Imports. Retaliating, China placed a 125% Tariff on US imports.

“Economic bullying that shifts risks onto others will ultimately backfire,” said a statement from the Chinese Ministry of Foreign Affairs.

Nigeria is benefitting from the tariff pause and will most likely use the next three months to negotiate a new trade deal for tariff reprieve.

Historically, Nigeria was a net importer of US goods, but because of Tinubu’s economic policies, the Naira has weakened against the dollar, making our exports relatively more competitive.

According to the latest Foreign Trade in Goods Statistics for Q4 2024, we maintained a positive trade balance with North America, a little above two trillion naira.

Asset Volatility Since March 24th 2025

| Asset | Lowest | Highest | YTD Chg % |

| XAU/USD | 2,956.600 | 3,220.20 | 20% |

| NAIRA/USD | 1,520.000 | 1,643.21 | 4% |

| US 10Y Yield | 3.860 | 4.515 | -5% |

| FGN 10Y Yield | 19.375 | 19.575 | -10% |

| S& P 500 | 4,910.420 | 5,786.950 | -10% |

| NSE30 | 3,858.90 | 3,926.29 | 2% |

| NGSEBNK | 1,079.01 | 1,166.56 | 4% |

| NGSEOIL | 2,404.52 | 2,509.740 | -10% |

- Investors flee to safe-haven assets typically gold (XAU/USD) and government bonds.

- Flight to safety has exacerbated over the past two weeks given the intensified trade war. Notably, US Treasuries are being swapped for the more neutral gold assets.

- Asset Managers are seeking safety amid the uncertainty, driving gold to new all-time highs twice over the past two weeks and the S&P 500 being sold off.

- Naira has held stable with intervention from CBN as FPI’s sell OMO’s, FGN bonds and local equities.

- CBN has intervened, injecting over $200 million injection in the FX market.

- This week, JP Morgan booked losses on their OMO carry trades in response to falling oil prices, raising macro economic risks.

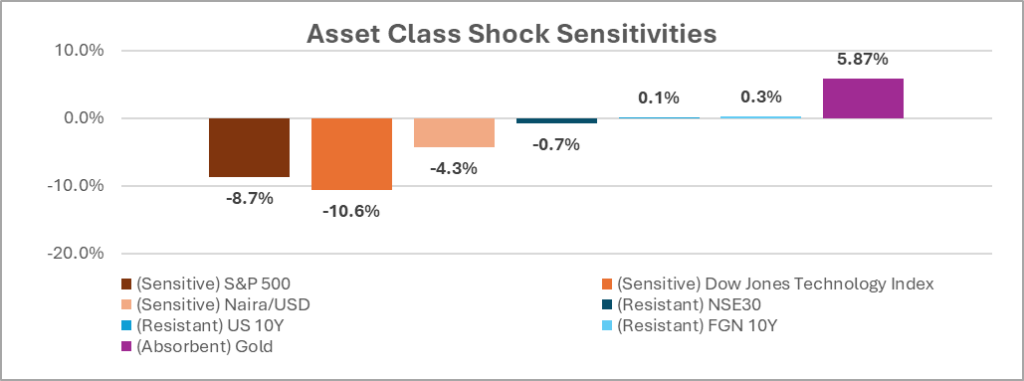

Shock Sensitive, Resistant, and Absorbent

Insights

- U.S stock indices although providing broad diversification benefits have been most sensitive to the U.S trade war as the growth of the individual companies have been thrown into uncertainty. Likewise, they have carried lofty valuations for a while and a repricing is currently taking place.

- Naira’s value has been volatile these past two weeks amid FPI’s flight to safety. We have seen the willingness of CBN to keep the currency in the 1500/1600 band, but this is unsustainable long term.

- NSE 30 provides sector diversification, offering broader safety as compared to specific sector exposure such as Banking or Oil & Gas sectors.

- Gold has shown to be shock absorbent as dollar valuations are volatile and US treasuries are being dumped by sovereign entities.

Risk-On vs Risk-Off Scenarios

Our Q2 2025 Market outlook shows that investors have been swinging between risk-on and risk-off appetites. When the tariffs were announced, risk-off sentiments prevailed. When tariffs paused, we witnessed brief risk-on behaviors.

Investors should be vigilant in both global and local developments over the next 90 days and take the following into consideration:

Risk-On Factors

- Positive developments related to trade negotiations during the 90-day tariff pause.

- U.S. Federal Reserve cut interest rates to avoid economic slow down. Goldman Sachs analysts predict a 45% chance of a recession in the next year.

- Local inflation continues to ease. Dangote has begun offloading fuel at the reduced price of N865, likely response to falling global oil prices.

- Recession nearly avoided and falling oil prices to boost demand.

- Likewise, Nigeria to increase oil production to meet 2.2 million budget target.

Risk-Off Factors

- US-China relations continue to worsen, and a deal is not reached soon. As of this writing, China has banned the export of rare earth metals to all countries.

- Trump administration reverses tariff pause and continues the offensive.

- Tension in Niger Delta region worsen, hampering the administration’s efforts to improve Nigeria’s fiscal stance.

- Global recession risk increases and oil demand slides.

These broad factors should shape asset allocations in the short term while broad macro

developments are closely monitored. We recommend shifting holdings to longer dated bonds and

gold. We advise not to “buy the dip” and hold on allocating more capital to equities as the situation

develops.