Fixed Income in Focus:

Liquidity deficit worsened by ₦1.2tn, closing at ₦1.9tn and marginally pushing yields higher. NTB activity started slow, with pockets of demand. But tight liquidity and excess supply signaled rising yields, prompting heavy offloading ahead of Wednesday’s auction, where 364-day NTB stop rates rose by 155 bps compared to previous auction. Bonds and OMOs followed, trading at even higher yields, with May 33s seeing the most activity ahead of its Monday reopening.

Nigerian Equities:

The ASI turned bullish this week cutting its losing streak with a 0.66% gain. Sentiment around the banking sector improved dramatically with the index registering a 5.61% gain, as investors position for the declared dividends of Tier 1 banks.

NTB Auction Result

| 91 Days | 182 Days | 364 Days | |

| Sales (₦‘bn) | 27.19 | 40.02 | 436.71 |

| Stop Rates | 18.00% | 18.50% | 19.94% |

FI Weekly Snapshot

| NTB | Bid | Ask | Effective Yield |

| % | % | % | |

| 19-Mar-26 | 19.40 | 19.30 | 23.85 |

| 12-Mar-26 | 19.40 | 19.10 | 23.44 |

| 05-Mar-26 | 19.45 | 19.15 | 23.41 |

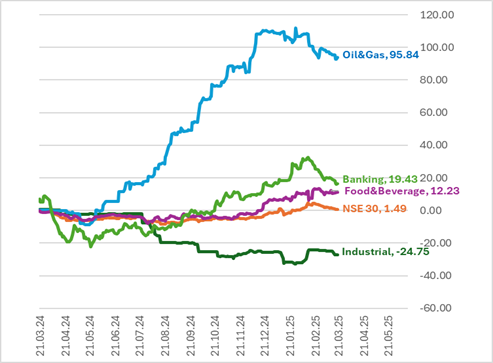

Indices Watch 1-Yr Performance %

This Weeks Market Movers

The Week Ahead…

Next week, the market will see a bond auction reopening the April 29s and May 33s and an NTB auction with a ₦700bn issue size. At the same time, ₦1.18tn in NTB repayments, ₦1.678tn in FAAC inflows, and ₦760bn in coupons and bond redemptions set to offset the ₦1.9tn deficit. The influx of funds should improve sentiments, leading to a possible stabilization or decline in rates. However, this sentiment may be marginal because of the upcoming auctions this week.