Our latest report breaks down the legal challenges to Trump’s tariffs and what they could mean for U.S. trade policy, global markets, and investors.

Key Points

- Legal Overreach and Court Ruling: Trump’s “Liberation Day” tariffs were ruled unlawful by the U.S. Court of International Trade on May 28, 2025.

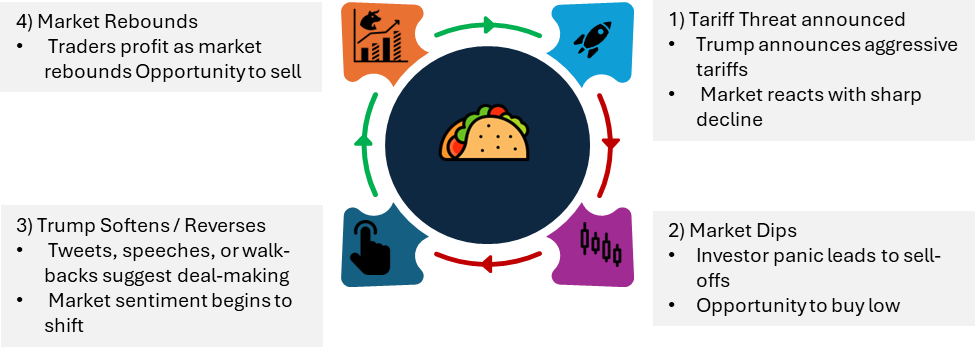

- Rise of the “TACO” Narrative emerging as a market meme reflecting Trump’s pattern of tariff threats followed by retreats.

- Economic and Policy Implications: Businesses, especially in manufacturing and tech, report rising costs and supply chain disruptions due to tariff uncertainty.

Trump’s Tariffs Under Fire: Legal Setback and the Rise of “Taco”

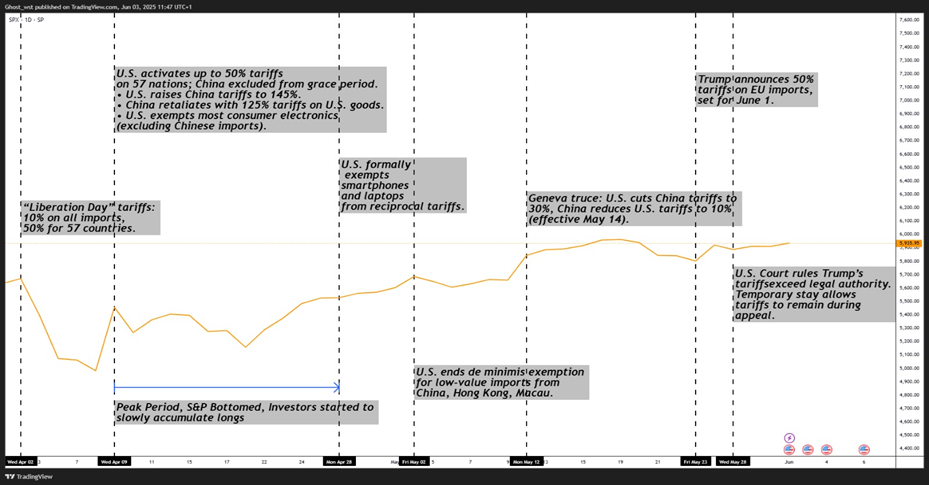

In April 2025, Donald Trump announced the “Liberation Day” tariffs broad import duties starting at 10%, rising higher for countries with major trade surpluses. The administration invoked emergency powers under the IEEPA, claiming the move was essential to protect American economic interests. But legal challenges quickly followed. On May 28, the U.S. Court of International Trade ruled the tariffs illegal, asserting that Trump had exceeded his legal authority. A federal appeals court temporarily stayed the ruling, allowing the tariffs to continue during the appeal process. As legal battles played out, financial markets coined a new acronym: TACO “Trump Always Chickens Out.” It reflects a pattern investors have noticed and started trading around: Trump announces aggressive tariffs, markets drop, and then he backtracks, sparking a rebound.

- Court ruling (May 28): Tariffs declared unlawful under IEEPA.

- Appeals court (May 29): Temporary stay issued; tariffs remain active.

- “TACO” effect: Coined by journalist Robert Armstrong; describes Trump’s tariff-reversal cycle.

- Political reaction: Democrats mocked the inconsistency; Newsom said, “It’s raining tacos today.”

The “Taco” Trade: A profitable pattern

S&P Reaction to Tariff Events

Wider Implications: Economic Fallout and Institutional Boundaries

The tariffs and their uncertain legal standing are creating turbulence across the economy. Businesses, especially in tech and manufacturing, are facing rising costs and disrupted supply chains. While the administration continues to use the tariffs as leverage in trade talks, critics warn this strategy undermines global confidence and adds avoidable volatility. Beyond economics, the case has raised fundamental questions about presidential authority and the role of Congress in trade policy. The outcome could set a major precedent for how emergency powers are interpreted and used.

- Business impact: Higher import costs, delayed shipments, procurement shifts.

- Diplomatic risks: Unilateral actions may damage U.S. trade relationships.

- Constitutional stakes: Could redefine executive power limits under IEEPA.

- Market uncertainty: Investors closely tracking legal outcomes and messaging.

Accessing the “Taco Trade”

The so-called “TACO trade” buying the dip on tariff threats and riding the rebound when Trump backs down has historical precedent and some tactical merit. It’s based on a recognizable pattern of tough talk followed by partial reversals or delays. Traders have capitalized on this volatility before, and 2025 is proving no different. However, markets may no longer react as sharply. The S&P 500’s steady rally since mid-April suggests investors are already pricing in the likelihood of reversals or legal challenges. In other words, the surprise factor is fading, and much of the tariff noise is being discounted as political theatre. That said, this doesn’t mean the risk is gone. A sudden escalation or a delay in expected policy reversals could still catch the market off guard.

Client Guidance:

- Business impact: Higher import costs, delayed shipments, procurement shifts.

- Diplomatic risks: Unilateral actions may damage U.S. trade relationships.

- Constitutional stakes: Could redefine executive power limits under IEEPA.

- Market uncertainty: Investors closely tracking legal outcomes and messaging.

The TACO strategy can deliver results, but it favors those who are informed, decisive, and ready to move quickly.

Kindly find the Report Below

Thanks for reading.