Presco Plc (NGX: PRESCO) stands out as one of Nigeria’s leading agro-industrial producers of palm oil and related products. Below are five key reasons why allocating capital to Presco shares could be a smart move for investors.

Discussion Points

• Presco’s Q1 2025 earnings and margin profile

• Value‑chain integration and capital efficiency

• Strategic expansion in West Africa

• Global palm oil market dynamics and price environment

• FX, trade‑war and local monetary policy impacts

1. Robust Q1 2025 Financial Performance

Key metrics (Q1 2025 vs. Q1 2024)

| Metric | Q1 2025 | Q1 2024 | YTD Chg % |

| Revenue | ₦93.8 billion | ₦42.5 billion | 120% |

| Profit After Tax | ₦47.6 billion | ₦24.1 billion | 98% |

| Earnings Per Share | ₦47.58 kobo | ₦24.06 kobo | 98% |

| Gross Margin | 92% | 79% | 13% |

| Operating Margin | 74% | 75% | -1% |

Insights:

Double‑digit top‑line growth amid FX headwinds underscores strong pricing power.

Exceptional conversion of sales into earnings supports robust cash‑flow generation.

2. Industry Leading Vertical Integration

Presco’s fully integrated model covers:

- Oil Palm Plantations (over 20,000 ha across Edo State and Ghana)

- Milling & Crushing (capacity >120,000 MT CPO annually)

- Refining & Packaging

Benefits:

- Cost Control: Eliminates middle‑man markups and ensures feedstock security.

- Margin Resilience: 74% operating margin far outpaces regional peers averaging ~40%.

- Volume Flexibility: Ability to shift product mix between crude palm oil, refined oils and specialty fats.

3. Superior Capital Efficiency

- Return on Equity (ROE): 27% in Q1 2025 (vs. 11% in Q1 2024)

- Return on Assets (ROA): 13% in Q1 2025 (vs. 7% in Q1 2024)

- Total Assets: ₦548 billion

- Total Equity: ₦178 billion

Driver Analysis

- Optimized Working Capital: Efficient inventory and receivables management in a volatile FX environment.

- Prudent CapEx: Focus on high‑ROI replanting and mill upgrades, rather than greenfield outlays.

- Strong Balance Sheet: Net debt/EBITDA <1x, providing optionality for opportunistic investments.

4. Strategic West-Africa Footprint Expansion

GOPDC Acquisition (Jan 2025):

- Acquired remaining 48% of Ghana Oil Palm Development Company.

- Brings total plantation area in Ghana to ~14,000 ha

- Expected incremental CPO output of 30,000 MT p.a., with ~15% EPS accretion by 2026

Cross-Border Synergies:

- Logistics: Shared port and haulage arrangements reducing export costs.

- FX Arbitrage: Revenue diversification in GHS and NGN mitigates single‑currency risk.

5. Favorable Industry Outlook & Macro Tailwinds

Global demand drivers:

- Market size: USD 61.19 billion in 2024 to grow to USD 88.84 billion by 2033 (CAGR 4.23%) according to Renub Market Research.

- Biofuel mandates which require 40% palm‑oil content are driving demand in Indonesia and tightening supply.

- Rising oleochemicals and personal‑care applications that require oil palm as a key ingredient

Price & volatility environment:

- Palm oil prices at decade highs on constrained output and surging biodiesel demand

- Gold and oil markets exhibit extreme swings; palm oil offers non‑correlated exposure.

Local FX & trade‑war impact:

- Naira weakness has made Nigerian CPO exports more competitive

- US-China tariff reprieve enhancing Nigeria’s access to North America; Nigeria has a positive trade balance of over a ₦2 trillion as of Q4 2024

- CBN interventions, with over $200 million injected this year, are stabilizing FX but signaling ongoing volatility.

Conclusion

Presco Plc’s combination of stellar Q1 2025 results, deep vertical integration, disciplined capital allocation, strategic West‑African expansion, and robust global demand dynamics provides a high‑conviction investment case. While vigilance is warranted around commodity and FX swings, we believe current valuations understate the upside potential embedded in Presco’s integrated palm‑oil platform.

Risks to consider:

- Commodity Price Reversal: A sharp drop in palm oil prices could compress margins.

- Currency Volatility: Further Naira devaluation may require FX hedging.

- Regulatory & ESG: Stricter environmental standards or land‑use policies in West Africa.

- Global Trade Tensions: Further heightened tensions between US and its trading partners may trigger another sell-off before the 90 tariff pause elapses.

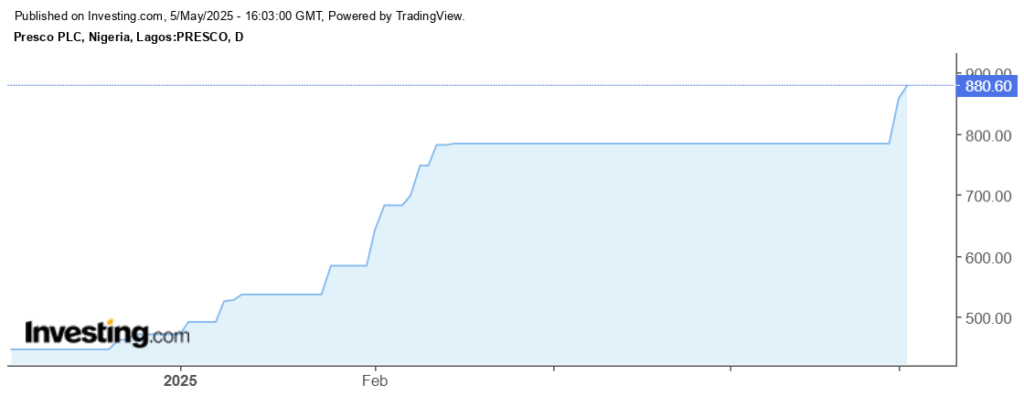

Image Source: Investing.com

Recommendation:

Buy: Allocate to Presco shares to capture margin expansion and FX tailwinds. At ₦880 per share, there is substantial upside to an estimated ₦950 per share.

Want to know more about our view on the escalating trade war?

Click on the link below: https://sphcapitalgroup.com/q2-2025-market-outlook-us-china-trade-war-investment-strategy-safe-haven-assets/